Subject Matter and Statutory Bar in CGST Proceedings

M/S Armour Security (India) Pvt Ltd v Commissioner, CGST

Case Summary

The Supreme Court held that the issuance of a summons under Section 70 of the Central Goods and Services Tax Act, 2017, does not amount to the formal initiation of proceedings under the Act.

M/S Armour Security received a show cause notice under Section 73 of CGST. Subsequently, CGST conducted a search...

Case Details

Judgement Date: 14 August 2025

Citations: 2025 INSC 982 | 2025 SCO.LR 8(3)[15]

Bench: J.B. Pardiwala J, R. Mahadevan J

Keyphrases: Section 70 of the Central Goods and Services Tax Act, 2017—summons—Section 6(2)(b) of the CGST Act—subject matter of proceedings—overlapping inquiries—initiation of proceedings

Mind Map: View Mind Map

Judgement

1. This matter was notified for admission on 03.2025. After hearing the learned Counsel appearing for the petitioner at length, and upon a threadbare examination of the reasoning assigned by the High Court, we decided to dismiss the Special Leave Petition. However, considering the nature of the issue involved, we thought it appropriate to assign reasons, and accordingly reserved the order.

2. This petition arises from the judgment and order passed by the High Court of Delhi dated 07.02.2025 in W.P.(C) No. 1082 of 2025 (“Impugned Order”), by which the High Court dismissed the writ petition filed by the petitioner herein, and declined from interdicting the summons dated 01.2025 and 23.01.2025 respectively, issued to the petitioner under Section 70 of the Central Goods and Services Tax Act, 2017 (for short, “the CGST Act”) by the Commissioner, Central Good and Services Tax, Delhi East Commissionerate (respondent no. 1).

A. FACTUAL MATRIX

3. The petitioner is a public limited company, incorporated under the Companies Act, 2013 and is registered with the Delhi GST authorities vide GSTIN: 07AADCA5862E2ZS. The company is engaged, inter alia, in the business of providing security services.

4. On 18.11.2024, the petitioner received a show cause notice issued under Section 73 of the CGST Act from the respondent no. 2 for tax period April 2020-March 2021. The show cause notice raised a demand of Rs. 1,24,92,162/- (aggregate of CGST, SGST, IGST) alongwith the applicable interest and penalty under Sections 50 and 74 of the CGST Act respectively. The said show cause notice was served on the ground that – (i) net tax under declared due to non- reconciliation of turnovers in other returns and e-way bill information; (ii) excess claim of ITC.

5. On 16.01.2025, a search was conducted at the registered premises of the petitioner under Section 67(2) of the CGST Act by the officers of respondent no. 1. A panchnama was drawn seizing electronic gadgets and documents. Thereafter, summons under Section 70 of the CGST Act was issued to four directors of the petitioner company requiring them to produce documents.

6. On 01.2025, the petitioner received one another summons under Section 70 of the CGST Act issued by the officer of respondent no. 1, directing one of the directors of the petitioner to produce relevant documents. The petitioner vide letter dated 24.01.2025 submitted a letter addressed to the respondent no. 1 stating that the petitioner is being investigated by the respondent no. 2, on similar grounds, including ITC claimed from cancelled suppliers. The petitioner also sought release of the seized electronic devices and documents.

7. Aggrieved by the summons dated 16.01.2025 and 23.01.2025 respectively, the petitioner preferred a writ petition before the High Court of Delhi on the ground that as the respondent no. 2 had already made the investigation in respect of the same issue and the respondent no. 1 does not have the jurisdiction in view of Section 6(2)(b) of the CGST Act.

B. IMPUGNED ORDER

8. The High Court dismissed the writ petition preferred by the petitioner and thereby declined to interfere with the summons issued to the petitioner on 16.01.2025 and 23.01.2025 respectively. The Court held that the expression “any proceeding” in Section 6(2)(b) cannot be construed to include a search or investigation. The High Court took the view that a summons or investigation pursuant to a search constitutes only a precursor to the formal proceedings. It distinguished such summons from assessment, noting that summons is primarily intended to elicit information.

9. The High Court noted that the intent of the statute is to prevent parallel proceedings relating to assessment, particularly those initiated under Sections 73 and 74 respectively of the CGST Act or any other analogous provisions. At the stage of issuing summons, the authorities are merely engaged in gathering information from the assessee based on the material collected thus far, as it is not yet possible to determine the specific course of action the authority intends to pursue.

10. Lastly, the High Court considered the decision of the High Court of Jharkhand in Vivek Narsaria v. State of Jharkhand, reported in 2024 SCC OnLine Jhar 50, which was relied upon by the petitioner to fortify his submissions. The Court held that the facts of the said case were distinguishable from those of the present In Vivek Narsaria (supra), both the State and Central GST authorities were conducting parallel inquiries, requiring the assessee to reverse the input tax credit. The Court observed that the search in the present case could not be construed as related to prior assessments or the pending proceedings, as it was conducted subsequent to those events.

C. SUBMISSIONS ON BEHALF OF THE PETITIONER

11. Sridhar Potaraju, the learned Senior Counsel appearing for the petitioner, would argue that Section 6(2)(b) of the CGST Act expressly prohibits parallel proceedings on the same subject matter by both the State and the Central GST authorities. He submitted that the summons issued by the respondent no. 1 concerning the subject matter i.e., availability of input tax credit in respect of cancelled dealers is barred under Section 6(2)(b), as the respondent no. 2 had already issued show cause notices on the same subject matter.

12. Potaraju submitted that the petitioner does not dispute the jurisdiction and authority of the Central GST authorities in respect of subject matters not covered by the show cause notices issued by the State authority. He further contended that the High Court erred in interpreting Section 6(2)(b) as being limited to proceedings under Sections 73 and 74 respectively, or other similar provisions. Consequently, the High Court erroneously held that the statutory bar under Section 6(2)(b) does not apply to summons issued under Section 70 of the CGST Act.

13. Potaraju drew the Court’s attention to Section 146 of the CGST Act to submit that that the common GST portal reflects complete records and status of all proceedings initiated by either the State or Central GST authorities. Accordingly, both the authorities are privy to any proceedings on any given subject matter. In the present case, the summons issued by the respondent no. 1 clearly specify the subject matter, which is evidently identical to that already under consideration of the respondent no. 2.

14. Further advancing his submission, Mr. Potaraju underscored the importance of harmony as a foundational principle of cooperative federalism, upon which the GST regime is He submitted that once either the State or Central authority initiates proceedings, the other is expected to act in aid of those proceedings and provide all necessary inputs to ensure their effective culmination. However, the simultaneous exercise of jurisdiction in the form of a parallel investigation on the same subject matter, he argued, runs contrary to the principle of harmony.

15. Potaraju relied upon D.O. F.No. CBEC/20/43/01/2017-GST (Pt.) dated 05.10.2018, issued by the Central Board of Excise & Customs, Ministry of Finance, to fortify his submission that the mandate of Section 6 of the CGST Act envisages a harmonious exercise of powers by the State and Union authorities. The Circular reads thus;

“Dear Colleague,

It has been brought to the notice of the Board that there is ambiguity regarding initiation of enforcement action by the Central tax officers in case of taxpayer assigned to the State tax authority and vice versa.

- In this regard, GST Council in its 9th meeting held on 16.01.2017 had discussed and made recommendations regarding administrative division of taxpayers and concomitant issues. The recommendation in relation to cross-empowerment of both tax authorities for enforcement of intelligence based action is recorded at para 28 of Agenda note no. 3 in the minutes of the meeting which reads as follows:-

“viii. Both the Central and State tax administrations shall have the power to take intelligence-based enforcement action in respect of the entire value chain”

- It is accordingly clarified that the officers of both Central tax and State tax are authorized to initiate intelligence based enforcement action on the entire taxpayer’s base irrespective of the administrative assignment of the taxpayer to any authority. The authority which initiates such action is empowered to complete the entire process of investigation, issuance of SCN, adjudication, recovery, filing of appeal etc. arising out of such action.

- In other words, if an officer of the Central tax authority initiates intelligence based enforcement action against a taxpayer administratively assigned to State tax authority, the officers of Central tax authority would not transfer the said case to its State tax counterpart and would themselves take the to its logical conclusions.

- Similar position would remain in case of intelligence based enforcement action initiated by officers of State tax authorities against a taxpayer administratively assigned to the Central tax

- It is also informed that GSTN is already making changes in the IT system in this regard.”

16. By relying on the decision in the Chief Commissioner of Central Goods and Service Tax v. Safari Retreats Pvt. Ltd., reported in (2025) 2 SCC 523, Mr. Potaraju further submitted that the CGST Act is a special statute and constitutes a self-contained code. As such, its provisions must be interpreted in a literal, plain, and strict manner. A literal reading of Section 6(2)(b), he argued, clearly envisages a bar on the initiation of any proceedings by a proper officer under the CGST Act on the same subject matter where proceedings have already been initiated by a proper officer under the SGST Act.

17. Potaraju submitted that the legislature has consciously employed the phrase “any proceedings”, which, in his view, is intended to encompass all proceedings initiated under the relevant GST enactment. The use of the word “any” in conjunction with “proceedings” reflects the legislative intent to give the provision a broad and inclusive scope. To buttress this submission, he relied on the decision in K.P. Mohammed Salim v. CIT, reported in (2008) 11 SCC 573. Furthermore, Section 6 of the CGST Act, is part of Chapter II of the Act which deals with Administration. As a sequitur, it ought to apply to all the “proceedings” contemplated under the subsequent provisions.

18. Lastly, Mr. Potaraju emphasized that officers under the GST regime are governed by the provisions set out in Chapter II of the CGST He pointed out that the term “proper officer,” as defined in Section 2(91) of Chapter I, refers to any officer assigned with any function under the Act. The CGST Act, he argued, does not draw distinctions or impose limitations on the exercise of powers by a proper officer. Rather, the definition operates as an overarching provision, uniformly applicable across the various Chapters of the Act.

19. In such circumstance referred to above, he prayed that there being merit in the present appeal, the same may be allowed and the Impugned Order passed by the High Court may be set aside and the summons dated 16.01.2025 and 23.01.2025 respectively be declared as having been issued without jurisdiction.

D. ANALYSIS

20. Having heard the learned Counsel appearing for the petitioner and having gone through the materials on record, the only question that falls for our consideration is whether the action of respondent 1, as complained of, amounts to an “initiation of proceedings” in respect of the “same subject matter” for the purposes of Section 6(2)(b) of the CGST Act.

I. Whether issuance of summons can be regarded as “initiation of proceedings” within the meaning of Section 6(2)(b) of the CGST Act?

21. One of the principal contentions raised by the petitioner herein for the purpose of assailing the Impugned Order is that the issuance of summons amounts to “initiation of proceedings” within the meaning of Section 6(2)(b) of the CGST Act.

a. Contrary Views of different High Courts on the issue

22. Before we proceed to answer the aforesaid contention canvassed on behalf of the petitioner, it would be appropriate to first refer to the decisions of various High Courts and the cleavage of opinion that have been expressed as regards the scope of “initiation of proceedings” within the meaning of Section 6 of the CGST Act.

i. Decisions interpreting the contours of “proceedings” in contrast to “inquiry” or investigation

23. The High Court of Allahabad in K. Trading v. Union of India & Ors., reported in 2020 SCC OnLine All 1907, examined the interplay between Sections 6 and 70 respectively of the CGST Act. The petitioner had received summons from the State GST authorities to explain two instances of availed input tax credit. Simultaneously, the petitioner was also summoned by the Central GST authorities to tender a statement in connection with the inquiry being undertaken by the Central GST authorities. Subsequent summons required the petitioner to produce various documents; however, he failed to furnish the requisite information.

The High Court held that the term “inquiry” as used in Section 70 of the CGST Act is not synonymous with “proceedings” under Section 6(2)(b). The Court clarified that proceedings under Section 6(2)(b) include actions relating to assessment, demand, and penalty, such as those initiated under Sections 73 or 74 respectively of the Act. Moreover, the Court interpreted the phrase “same subject matter” in Section 6(2)(b) to refer to the same cause of action concerning the same dispute being adjudicated before a proper officer. In the Court’s view, the reference to “subject matter” implies an adjudicatory proceeding founded on an identical cause of action. The relevant observations read as under:

“10. The words “subject-matter”, “proceedings” and “inquiry” have not been defined either under the State GST Act or the Union Territory GST Act or the CGST Act. Therefore, these words have to be interpreted in the context of the aforesaid Acts. The word “inquiry” in section 70 has a special connotation and a specific purpose to summon any person whose attendance may be considered necessary by the proper officer either to give evidence or to produce a document or any other thing. It cannot be intermixed with some statutory steps which may precede or may ensue upon the making of the inquiry or conclusion of inquiry. The process of inquiry under section 70 is specific and unified by the very purpose for which provisions of Chapter XIV of the Act confers power upon the proper officer to hold inquiry. The word “inquiry” in section 70 is not synonymous with the word “proceedings”, in section 6(2)(b) of the UPGST Act/CGST Act.

xxx

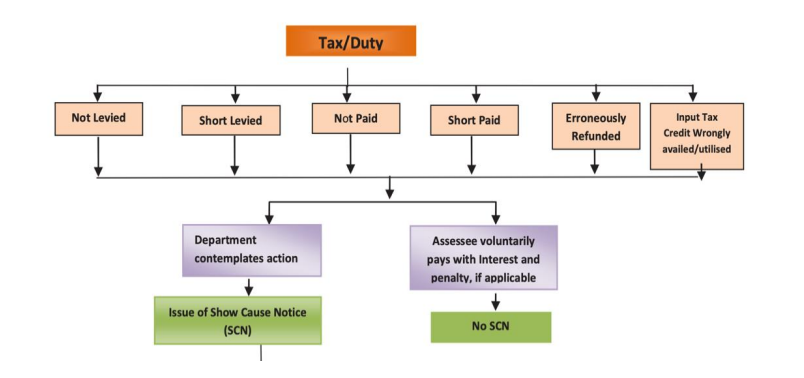

- Provisions of section 70 has been enacted for collecting evidence in matters involving tax evasion which may also lead to confiscation. After inquiry is completed and materials for tax not paid or short- paid or erroneously refunded or input-tax credit wrongly availed or utilized, by reason of fraud or wilful misstatement or suppression of facts or otherwise are found, then it may lead to demands and recovery under section 73 or section 74, as the case may be. When action for assessment, demand and penalty, etc., including action under section 73 or 74 is taken, that shall amount to proceedings referable to section 6(2)(b) of the Act but the inquiry under section 70 is not a proceeding referable to section 6(2)(b) of the Act.

xxx

- Thus, section 6(2)(b) of the CGST Act prohibits separate initiation of proceedings on the same subject-matter by the proper officer under the CGST Act when proceeding on the same subject-matter by the proper officer under the State Act has been initiated, whereas section 70 of the UPGST/CGST Act merely empowers the proper officer to summon any person in any inquiry. The word “proceedings” used in section 6(2)(b) is qualified by the words “subject- matter” which indicates an adjudication process/proceedings on the same cause of action and for the same dispute which may be proceedings relating to assessment, audit, demands and recovery, and offences and penalties, etc. These proceedings are subsequent to inquiry under section 70 of the Act. The words “in any inquiry” used in section 70 of the Act is referable to the provisions of Chapter XIV, i. e., section 67 (power of inspection, search and seizure), section 68 (inspection of goods in movement), section 69 (power to arrest), section 71 (access to business premises) and section 72 (officers to assist proper officers). Therefore, proper officer under the UPGST Act or the CGST Act may invoke power under section 70 in any inquiry. Prohibition of section 6(2)(b) of the CGST Act shall come into play only when any proceeding on the same subject- matter has already been initiated by a proper officer under the UPGST Act.”

(Emphasis supplied)

24. The High Court of Madras in Kuppan Gounder P.G. Natarajan v. Directorate General of GST Intelligence, reported in 2021 SCC OnLine Mad 17053, dealt with a challenge to summons issued by the respondent on the ground that the appellant’s company fell within the state jurisdiction under the SGST Act, and the respondent is an authority with the central The Court held that the scope of Sections 6(2)(b) and 70 respectively, are different and distinct, as the former deals with any proceedings on a same subject matter, whereas, the latter deals with power to summon in an inquiry and therefore, the words “proceedings” and “inquiry” cannot interchangeably be used to say that there is a bar to invoke the power under Section 70 of the CGST Act. The Court referred to the proceedings under Section 67, 68, 69, 71 and 72 respectively as “inquiry”. It was further observed that the prohibition under Section 6(2)(b) shall come into play when any proceedings on the same subject matter had already been initiated by a proper officer of another tax authority. The relevant observations read as under:

“31. We need to take note of the word “inquiry” occurring in Section 70 of the CGST Act and the proper officer has power to summon any person whose attendance he considers necessary to give evidence or to produce a document or any other thing in any inquiry, in the same manner, as provided in the case of a Civil Court. The bar contained under Section 6(2)(b) of the CGST Act is with regard to any proceedings initiated by a proper officer on a subject matter, on the same subject-matter, the proper officer under the Central Act cannot initiate any action referred.

- In our considered view, the scope of Section 6(2)(b) and Section 70 is different and distinct, as the former deals with any “proceedings on a subject matter/same subject matter” whereas, Section 70 deals with power to summon in an inquiry and therefore, the words “proceedings” and “inquiry” cannot be mixed up to read as if there is a bar for the respondent to invoke the power under Section 70 of the CGST Act.”

(Emphasis supplied)

25. The High Court of Orissa in Anurag Suri v. Director General of Goods and Services Tax Intelligence & Ors., reported in 2021 SCC OnLine Ori 2510, dealt with a challenge to show cause notice and subsequent orders issued by the State GST authority, despite the Central GST authority already being seized of the During a search conducted at the petitioner’s business premises by the Central GST authority, documents were seized and summons were issued. The petitioner therein participated in the proceedings arising therefrom. Subsequently, the State GST authority issued a show cause notice alleging that tax dues had not been paid or had been short-paid, that refunds had been erroneously released, or that the input tax credit had been wrongly availed or utilized. The petitioner was called upon to pay the tax along with interest and penalty. The petitioner requested that the proceedings initiated by the State GST authority be kept in abeyance until the conclusion of the proceedings before the Central GST authority. Nevertheless, the State GST authority proceeded to pass an order directing the petitioner to pay the demanded amount.

The High Court noted that the period of enquiry by the Central GST authority spanned from July 2017 to June 2018, whereas, the show cause notice issued by the State GST authority pertained to March 2018. Therefore, there was an overlap in the periods under scrutiny. In view of this, the High Court quashed the show cause notice and the subsequent orders issued by the State GST authority. The relevant observations read as under:-

“14. Counsel for the Opposite Parties does not dispute that the circular dated 5th October, 2018 precludes the State GST authorities from proceeding in the matter as long as the Central authorities are seized of it. The only submission by Mr. Chimanka is that the Appellant should continue to cooperate with the Central GST authorities and appear as and when required by them to do so.

15. Learned counsel for the Appellant states that the Appellant has already been cooperating and would continue to do so as far as the proceeding initiated by the DGGSTI (Opposite Party No. 1) is concerned.

16. It may be noted that the period of enquiry as far as Central tax authority is concerned is from July, 2017 to June, 2018 whereas Opposite Party No. 3 has issued a show cause notice specific for March, 2018 and, therefore, there is also an overlapping of the periods.

xxx

- For the reasons noted above, the Court quashes the show cause notice dated 23rd July, 2019, the impugned order dated 5th November, 2019 including the order dated 4th November, 2019 all passed by Opposite Party No. 3 and directs that till the conclusion of the proceeding initiated against the Appellant by the DGGSTI, no coercive action be taken against the Appellant by the Opposite Party No. 3.”

(Emphasis supplied)

26. In Indo International Tobacco Ltd. v. Vivek Prasad, reported in 2022 SCC OnLine Del 90, the petitioner approached the High Court of Delhi, aggrieved by multiple search operations and summons. A search was initially conducted by the Central GST authorities in Gautam Buddha Nagar, followed by the issuance of a show cause notice. Thereafter, the bank account of the petitioner was provisionally attached and summons were issued to produce various documents. Subsequently, the petitioner’s premises were subjected to searches by multiple units of the Directorate General of GST Intelligence (DGGI), Lucknow Zonal Unit, DGGI, Delhi Zonal Unit, DGGI, Ghaziabad, DGGI, Ahmedabad.

The Court observed that an assessee may fall within the jurisdiction of a State Tax Officer, a Central Tax Officer, and a Central Tax Officer having pan-India jurisdiction. In the context of Section 6, the Court observed that the purport of Section 6 is to eliminate the assessee from being subjected to multiple jurisdictions. However, the Court further clarified that neither Section 6 nor the Circular dated 05.10.2018 would apply to fact-situations where the inquiry, investigation, or proceedings have implications extending beyond the territorial jurisdiction of the initiating officer. It categorically observed that the Circular does not contemplate situations where actions, by Central or State, or only Central or State, have a common thread involving multiple taxpayers. In such cases, requiring an officer to limit the scope of investigation to his territorial jurisdiction would be impractical and would, in turn, subject the assessee to multiple overlapping actions. The relevant observations read as under:

“64. The above circular is intended to give effect to the mandate of section 6 of the CGST Act and the pari materia provisions in the State Act(s). It states that the mandate of section 6 shall apply even to the “intelligence based enforcement action”. It clarifies that the Central tax officers as also the State tax officers are authorized to initiate intelligence based enforcement action on the entire taxpayer’s base “irrespective of the administrative assignment of the taxpayer to any authority” and that the authority which initiates such action is empowered to complete the entire process of investigation, issuance of show- cause notice, adjudication, recover, etcetera. It further clarifies that even though the taxpayer may be administratively assigned to the other authority- State or Centre as the case may be, the officer initiating “intelligence based enforcement action” need not transfer the said case to the authority otherwise having administrative assignment over the taxpayer.

- The above circular is one example where section 6 shall have its full play. In terms of section 6(1), the State or the Central Tax Officer as the case maybe, is also authorised to act as the “proper officer” for the purposes of the other Act-CGST or the SGST Act as the case maybe. Therefore, when such officer initiates “intelligence based enforcement action”, he acts and is empowered to so act not only under the CGST Act but also under the SGST or the UTGST Act. In terms of section 6(2)(a), he has to pass a comprehensive order, both under the CGST and the SGST/UTGST Act. In terms of section 6(2)(b), as he has initiated “intelligence based enforcement action”, the other jurisdiction officer must hold his hands and the officer initiating such “intelligence based enforcement action” need not transfer the case to the jurisdiction officer to whom otherwise the taxpayer is administratively assigned.

xxx

- A bare reading of section 6 of the CGST and the above mentioned circular, on first blush, supports the interpretation put forth by the learned senior counsel for the appellants. However, in our opinion, neither section 6 of the CGST Act nor the circular dated October 5, 2018 is intended to nor can be given an over arching effect to cover all the situations that may arise in the implementation of the CGST and the SGST Acts. The circular cannot be extended to cover all and myriad situations that may arise in the administration and the functioning of the GST structure, now being governed by the CGST Act ; the SGST Act ; the UTGST Act ; and the IGST Act. Section 6 of the CGST Act and the above said circular clearly has a limited application, which is of ensuring that there is no overlapping exercise of jurisdiction by the Central and the State Tax Officers. It is to bring harmony between the Centre and the State in the implementation of the GST regime, with the two not jostling for jurisdiction over a taxpayer. It is, however, not intended to answer a situation where due to complexity or vastness of the inquiry or proceedings or involvement of number of taxpayers or otherwise, one authority willingly cedes jurisdiction to the other which also has jurisdiction over such inquiry/proceedings/taxpayers.

- Neither section 6 of the CGST Act nor the SGST Act nor the Circular dated October 5, 2018, therefore, apply to the fact-situation presented by the two petitions before us as they do not operate and are not intended to operate in a situation where the “intelligence based enforcement action” has repercussion or involvement of taxpayers beyond the territorial jurisdictional limit of the officer initiating such an action. It also does not address a situation where two or more officers, may be Central or State or only Central or State, initiate separate “intelligence based enforcement action” but having a common thread or involvement of multiple taxpayers, like a case of conspiracy. In the first case, the officer initiating the “intelligence based enforcement action” cannot travel beyond his territorial jurisdiction. To strictly enforce section 6 and the above mentioned circular would therefore, lead to compelling such officer to restrict his investigation and findings and resultant action only to the taxpayer within his territorial jurisdiction, thereby leading to an incomplete and inconclusive investigation/action. In the above mentioned second scenario, as all officers who have initiated “intelligence based enforcement action” are otherwise having jurisdiction over the taxpayer, strictly enforcing the mandate of section 6 and the above mentioned circular, will on the one hand subject the taxpayer to multiple action(s) (which is completely contrary to the intent of the Act as noted hereinabove), while on the other hand lead to multiple authorities expending their time, energy and resources investigating the same “intelligence” input, may be even reaching to conflicting findings. It is settled principle of interpretation of statute that the court must adopt construction which will ensure smooth and harmonious working of the statute and eschew the other which will lead to absurdity or give rise to practical inconvenience or friction or confusion in the working of the system. (Refer : State of Punjab v. Ajaib Singh AIR 1953 SC 10 ; Collector of Customs, Baroda v. Digvijaysinhji Spinning & Weaving Mills Ltd. AIR 1961 SC 1549)”

(Emphasis supplied)

27. The High Court of Kerala in T. Saidalavi v. State Tax Officer, reported in 2024 SCC OnLine Ker 5674, dealt with a case where the Central GST authority had initiated an enquiry concerning non- payment of GST, directing the production of certain records, followed by the issuance of summons under Section 70 of the CGST Act. During the pendency of this enquiry, the State GST authority initiated proceedings under Section 74 of the respective State GST enactment. The Court held that the initiation of an enquiry or issuance of summons under Section 70 cannot be equated with the initiation of proceedings for the purposes of Section 6(2)(b) of the CGST Act. The term “initiation of any proceedings” is in reference to the issuance of a notice. It further observed that the Circular dated 05.10.2018 did not appear to be in consonance with the mandate of Section 6(2)(b) of the Act. The relevant observations read as under:

“7. […]Sub-section (2) of Section 6 with which we are concerned, indicates that, where a proper officer under the CGST Act has issued an order under the provisions of the said Act, he shall also issue an order under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act as the case may be under the intimation to the jurisdictional officer of the State Tax or the Union Territory Tax Authority as the case may be. The Section further provides that where a proper officer under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act has initiated any proceedings on a subject matter, no proceedings shall be initiated by the proper officer under the CGST Act on the same subject matter. On a reading of the provisions, unaided by the authority, I am unable to conclude that the contention of the learned counsel for the appellants must be accepted. The term ‘initiation of any proceedings’ is no doubt a reference to the issuance of a notice under the provisions of the CGST/SGST Acts and the initiation of an enquiry or the issuance of summons under Section 70 of the CGST/SGST Acts cannot be deemed to be initiation of proceedings for the purpose of Section 6(2)(b) of the CGST/SGST Acts. I find support for this view from the judgment of the Allahabad High Court in G.K Trading Company (Supra) where the court held as follows;[…]”

(Emphasis supplied)

28. The High Court of Rajasthan in Rais Khan v. Commissioner, Enforcement Wing-II, D.B. Civil Writ Petition No. 3087/2024, dealt with a challenge to the issuance of summons by the DGGI, on the ground that the proceedings had already been initiated by the State GST authority. The Court observed that the terms “proceedings” under Section 6(2)(b) of the CGST Act and “inquiry” under Section 70 cannot be conflated to imply a bar on the issuance of summons. It held that the mere issuance of summons does not amount to the initiation of proceedings under Section 6(2)(b). The relevant observations read as under:

“11. In the judgments referred to by counsel for the respondents, it is held that scope of Section 6(2)(b) and Section 70 of the CGST Act is different and distinct, as the former deals with any proceedings on subject matter, whereas the latter deals with power to issue summon in an inquiry and therefore, the words “proceedings” and “inquiry” cannot be mixed up to read as if there is a bar for the respondents to invoke the power under Section 70 of the CGST Act. In “G.K. Trading Company vs. Union of India”, the Allahabad High Court has held that issuance of summons is not initiation of proceedings referable to under Section 6(2)(b) of the CGST Act. Similar is the view of Madras High Court in “Kuppan Gounder P.G. Natarajan vs. Directorate General of GST Intelligence, New Delhi”, wherein, Court has also held that in issuance of summons for conducting an inquiry and to obtain a statement from the appellant cannot be construed to be bar under Section 6(2)(b) of the CGST Act.

- In view of the above, we are of the considered view that issuance of summons under Section 70 of the CGST Act is not hit by Section 6(2)(b) of the CGST Act and the present Civil Writ petition being devoid of merits is accordingly dismissed. Stay application stands disposed.”

(Emphasis supplied)

ii. Decisions interpreting “proceedings” in association to “inquiry” or investigation

29. The High Court of Calcutta in M/s. R.P. Buildcon Pvt. Ltd. v. Superintendent, CGST & CX, Circle-II, Group-10, reported in 2022 SCC OnLine Cal 3108, dealt with an appeal wherein the appellant therein, inter alia, sought quashing of notices issued by the Central GST authority (Anti-Evasion) in respect of the financial years 2017-18 to 2019-20, for which an audit under Section 65 of the CGST Act had already been conducted by another wing of the Central GST authority. The appellant also sought a declaration that scrutiny of returns under Section 61 of the CGST Act could not have been undertaken for the same period once an audit under Section 65 had been completed.

The Court observed that different wings of the same Department had initiated action for the same period and held that audit falls within the ambit of “proceedings” under Section 6(2)(b). Accordingly, it directed that the two wings which had initiated proceedings subsequently be restrained from proceeding further in respect of the said financial years. The relevant observations read as under:

“7. Therefore, we are of the view that since the audit proceedings under section 65 of the Act has already commenced, it is but appropriate that the proceedings should be taken to the logical end. The proceedings initiated by the Anti Evasion and range office for the very same period shall not be proceeded with any further.

xxx

10. It is made clear that the above direction is confined only for the period covered for the financial years 2017-2018, 2018-2019 and 2019-2020. If there are any other material required by the second and third respondents for a Department assessment period, it will be well open to them to put the appellants on notice in that regard.”

(Emphasis supplied)

29. The High Court of Madras in Metal Trade Incorporation v. Special Secretary, Head of the GST Council Secretariat, New Delhi, reported in 2023 SCC OnLine Mad 8234, considered a challenge to summons issued by both the State and Central GST authorities. The petitioner therein contended that simultaneous proceedings by both authorities on the same subject matter were impermissible. The Court held that it was not permissible for the State GST authorities to prosecute the petitioner therein again, as the Central GST authority had already initiated action in respect of the same matter. However, the Court granted the petitioner an opportunity to participate in the proceedings initiated by the State GST authority to ascertain whether both sets of proceedings indeed pertained to the same subject matter. The relevant observations are reproduced herein:

“5. Admittedly, no final decision has been taken by the fifth respondent to initiate action against the appellant under the TNGST Act, 2017. The appellant has only been called upon to produce documents under the impugned Summons dated 18-10-2022 and he has also been called to come for personal hearing. Admittedly, the appellant has not participated in the personal hearing and instead he has chosen to file this Writ Petition, challenging the impugned Summons. Necessarily, to substantiate his defence that he cannot be once again prosecuted by the State Authority under the TNGST Act, 2017, he has to participate in the enquiry to be conducted by the fifth respondent and only then it can be ascertained whether the proceedings initiated by the Central and State Authority are one and the same involving the same subject matter. Truth will come out only when the appellant appears before the respondent pursuant to the Summons received by him and not otherwise. If it is the same subject matter, the State Authority cannot prosecute the appellant once again as the Central Authority has already initiated action against the appellant in respect of the very same subject matter. The appellant has sent a detailed reply on 27-10-2022 to the impugned Summons dated 18-10-2022 and even without allowing the same to be considered by the fifth respondent on merits, the appellant has approached this Court prematurely by filing this Writ Petition.

- As observed earlier, necessarily, the appellant will have to participate in the personal hearing and state all his objections with regard to the action launched by the State Authority under the TNGST Act, 2017. Unless and until the appellant participates in the impugned proceedings viz., the impugned Summons dated 18-10-2022, truth cannot be unearthed with regard to the appellant’s contentions.”

(Emphasis supplied)

31. The High Court of Jharkhand in Vivek Narsaria (supra), dealt with a petition wherein the petitioner therein sought a direction that the proceedings be continued by the State GST authority, and not by the Preventive Wing of the Central GST authority or the DGGI. An inspection was initially carried out at the instance of the State GST authorities, during which the books of account were requisitioned. Subsequently, the petitioner was served with a notice by the Preventive Wing of the Central GST authority directing reversal of input tax credit along with interest and penalty, on the allegation of purchases from non-existent While both Departments were seized of the matter, the DGGI conducted a search and effected seizures. The petitioner therein was also summoned at regular intervals by both the Preventive Wing of the Central GST authority and the DGGI.

The High Court observed that the actions taken by any authority form part of a chain of events occurring under the Act, and that every enquiry or investigation initiated by any authority is interrelated. It held that as the State authorities had initiated the same proceeding for wrong/illegal availment of input tax credit, the DGGI does not possess any special powers exceeding those conferred on the officers of the State GST authorities. Accordingly, the Court directed the Preventive Wing of the Central GST authority and the DGGI to transfer their investigation in relation to the petitioner therein to the State GST authorities. The relevant observations read as under:-

“14. Having heard the arguments advanced by respective parties and having perused the documents brought on record and the statements and averments made in the respective counter-affidavits and materials available on record, we find that bare perusal of section 6 of the Act, especially section 6(2)(b), when read with the Clarification dated October 5, 2018, further read with Clarification dated June 22, 2020, when read together, it clearly denotes and implies that it is a chain of a particular event happening under the Act and every and any enquiry/investigation carried out at the behest of any of the Department are interrelated. Even if, we accept the submission of respondent No. 5 that the proceedings initiated by respondent No. 5 is on the basis of an information received from Noida; in that event also, we are at loss to say that the DGGI is raising a question about credibility and competence of the State GST Authorities, in carrying out the investigation concerning wrong/inadmissible availment of Input-tax Credit, inasmuch as, the officers of the DGGI does not enjoy any special power or privilege in comparison with the officers of the State GST Authorities.

- We are little hesitant to accept such argument, inasmuch as, the State Authorities has also initiated the same very proceeding for wrong/illegal availment of input-tax credit. Undeniably, the proceedings at the instance of State Authorities or the Preventive Wing or the DGGI is at initial stage and the proceedings on the basis of “Search and Seizure” by the State Authorities, is prior in point of time. Hence, section 6(2)(b) read with clarification dated October 5, 2018, adds to the issues raised by the appellant herein and manifestly crystallizes that since all the proceedings are interrelated, the State authorities should continue with the proceedings.”

(Emphasis supplied)

32. The High Court of Punjab & Haryana in Stalwart Alloys India Ltd. v. Union of India & Ors., reported in 2024 SCC OnLine P&H 15153, held that any action taken by any Department amounts to judicial proceedings but the Departments are within their right to initiate proceedings and take them to their logical conclusion. In that case, an enquiry had been initiated both by the State GST authority and by multiple Zonal Units of the DGGI regarding the wrongful availment of input tax credit. The petitioner filed a writ petition, pursuant to which the State GST authority was directed to continue the enquiry proceedings. In aid of this, the petitioner was directed to submit records, including ledger accounts, sales and purchase invoices, and proof of payment, up to 31 January 2021. Subsequently, fresh search and seizure proceedings were undertaken by the DGGI. The DGGI granted permission to the concerned Zonal Unit to conduct a centralized investigation against the petitioner for the period after 2019. In this context, the State GST authority transferred the proceedings to the concerned Zonal Unit of the DGGI.

The High Court observed that the CGST Act does not contemplate the transfer of proceedings from one proper officer to another. Accordingly, no authority has the power to transfer a case from its jurisdiction to another, nor can any authority direct such a transfer. The Court held that actions taken by a proper officer under the Act were in the nature of judicial proceedings, which cannot be transferred through administrative orders. It further held that both the State and Central GST authorities are vested with equal powers under the relevant GST enactments, and once proceedings have been initiated by one authority, the same cannot be transferred to another. The relevant observations read as under:

“22. We have considered his submission but find ourselves unable to accept the same in terms of scheme of the GST Act. As noticed above, the GST Act of 2017 empowers both the State authority as well as Central authority with equal powers. Once we have held that the proceedings are in the nature of judicial proceedings. The corollary, such judicial proceedings cannot be transferred by administrative actions. Merely because the DGGI has information relating to similar fraudulent availment of ITC by other firms who may be related to the firm against which the proceedings have been initiated under section 74 of the HGST Act by the State authority itself would not be a sufficient ground to presume that the State GST authority would not be able to conduct the proceedings or examine the culpability of the firm against whom proceedings under section 74 of the HGST Act have been initiated. Merely because there may be other firm also against whom proceedings are initiated, there is no concept of joint proceedings. In view of the above, we do not subscribe to the contentions raised by learned Assistant Solicitor General.

xxx

- The import of the aforesaid Circular dated October 5, 2018 is to be understood to mean that when an inquiry is conducted by a proper officer of the State and investigation is required to be done by the Central Tax Officer, the Central Tax Officer would exercise the said power for the purpose of investigation. However, it would not mean that the proceedings being conducted by the State Tax Officer would also be transferred to them. They would only be in a position as investigating officer as is done in any criminal case. Their report relating to their investigation at the level of Pan India will have to be submitted to the State Tax Officer who has initiated the proceedings and as a State Tax Officer has the power to issue summons and warrants of arrest which would be applicable to Pan India. There is no reason to believe that the proceedings in any manner would be hampered or would suffer as against the company/firm against which proceedings have been initiated under section 74 of the Act.”

(Emphasis supplied)

Further, the High Court interpreted the term “subject matter” as used in Section 6(2)(b) of the CGST Act to refer to the nature of the proceedings. In the facts of the case, the Court construed the subject matter to be the proceedings initiated for the wrongful availment of input tax credit. On this basis, it held that the DGGI was precluded from initiating proceedings, even for a different period, where the State GST authority had already initiated proceedings on the same subject matter. The relevant observations read as under:

“29. In the opinion of this court, the word “subject- matter” used in section 6(2)(b) of the Act would mean “the nature of proceedings”. In the present case, thus, it would mean the proceedings initiated for wrongful availment of input-tax credit by fraudulent means. Thus, if the State has already initiated proceedings by issuing notice under section 74 of the Act for the period up to July 22, 2019, for the same subject- matter, the DGGI cannot be allowed to initiate proceedings for the availment of input-tax credit by fraudulent means for the period from July 28, 2019 to January 20, 2022. Such action, if allowed, would be contrary to the provisions contained in section 6(2)(b) of the Act.”

(Emphasis supplied)

33. The High Court of Himachal Pradesh in Kundlas Loh Udyog v. State of P., reported in 2024 SCC OnLine HP 4810, dealt with a case where the petitioner was issued summons by the State GST authorities, directing him to furnish details of all suppliers from September 2021, for the tax period spanning April 2019 to December 2023. Subsequently, the petitioner therein received summons from the Central GST authority concerning supplies made by five specific suppliers. The petitioner informed the Central authorities that proceedings with respect to the named suppliers had already been initiated by the State authorities and that the relevant documents had been submitted to them. Nevertheless, the Central authorities proceeded to block the input tax credit on account of the transactions involving the said suppliers.

The Court held that Section 6(1) of the CGST Act empowers the officers appointed under the State enactment to act as proper officers for the purposes of the CGST Act as well. It observed that the object of Section 6(2)(b) of the CGST Act is to prevent the cross- empowerment in a manner that results in taxpayers being subjected to parallel proceedings. The Court interpreted the term “subject matter” to refer to the nature of the proceedings, and clarified that if any new information is gathered by the latter authority, it ought to be shared with the authority already seized of the investigation. The relevant observations read as under:

- Further in conformity with the scheme of cross empowering officers under the said enactments, Clause (a) of Section 6(2) of the Act also empowers a proper officer to issue orders under the SGST Act and the said Act. Similarly, officers under the SGST Act and the UGST Act are also empowered to issue orders under the The only condition is that the issuance of such orders is required to be intimated to the Jurisdictional Officer of the central tax or the state tax, as the case may be.

- To ensure that there are no multiple proceedings in regard of the central and the state officers being authorized as proper officers, Clause (b) of Section 6(2) of the Act provides that where a proper officer under the SGST Act and the UGST Act has initiated proceedings on a subject matter, the proper officer under the Act would not initiate proceedings “on the same subject matter”. This provision of CGST is also mirrored by Clause (b) of Section 6(2) of the SGST Act and UGST Act as well. Thus, where a proper officer under the CGST Act had initiated proceedings on a subject matter, no proceedings would be initiated by proper officer authorized under the SGST Act or UGST Act on the same subject matter.

- It is clear that the object of Section 6(2)(b) of the Act is to ensure that cross empowerment of officers of Central Tax and State Tax do not result in the taxpayers being subjected to parallel proceedings.

- Noticeably, Section 6 (2) (b) of the Act treats the empowered officers under the SGTS/UGST Act at the central level to be at par and does not prescribe for transfer of investigation of the proceedings from State authority to the Central authority or vice-versa.

- The object of Section 6(2)(b) of the Act is to avoid multiple proceedings by the Sales Tax Officer and Central Tax Officer on the same subject matter and the Rules of purposive interpretation requires Section 6(2)(b) of the Act to be read in light of this object.

xxx

- It would be an entirely different matter that if there would have been another firm which has also been found to be availing fraudulent ITC, then the central government authorities would not be precluded from taking action against that firm. The independent action against some other firms would not impede the proceedings already initiated by the State Tax Any new information which the respondent No. 2 may have gathered related to fraudulent availment or passing on can always be informed to the authorities, who already conducting the investigation, inquiry and proceedings under Section 6(2) of the Act.

- In my considered opinion, the word “subject- matter” used in Section 6(2)(b) of the Act would mean, “the nature of proceedings”. In the present case, it would thus mean the proceedings initiated prior at any point of time vide Annexure P-1 by respondent No. 1 and, therefore, for the same subject matter, respondent No. 2 cannot be allowed to initiate proceedings. Such action, if allowed, would be contrary to the provisions contained in Section 6(2)(b) of the Act.

(Emphasis supplied)

b. Framework of single interface and cross-empowerment of powers under Section 6 of the CGST Act

34. The unique scheme and framework of the Goods and Services Tax regime envisages two distinct concepts at its heart, the concept of a “single interface” as-well as the concept of “cross-empowerment”. The former relates to doing away of dual administrative control over the collection as-well as assessment of tax returns by tax payers, that had existed previously, in the erstwhile scheme of indirect taxes in the form of value added tax or VAT. Whereas, the latter, pertains empowering both the Central and State tax administrations to simultaneously undertake enforcement actions against a tax-payer.

35. While at the first blush, both these concepts may appear to be in contradiction to one another, however, a closer and more considered examination of these concepts within the GST framework would reveal that they are complementary to one another. Both these concepts have been consciously adopted and incorporated within the GST framework and have been designed to work in tandem for achieving the avowed object of GST.

36. At the time of the framing of the Goods and Services Tax Act, it was consciously decided that taxpayers should not be subjected to the jurisdiction of both the Central and State tax authorities simultaneously. To prevent the burden of dual administrative control and to streamline compliance, the concept of a “single interface” was introduced. Under this model, only one tax administration would exercise exclusive control over a taxpayer in relation to all aspects of GST compliance. This included matters pertaining to Central GST (CGST), State GST (SGST), and Integrated GST (IGST).

37. The underlying objective of this arrangement was to simplify the taxpayer’s engagement with the tax system by ensuring that all notices, audits, assessments, and other proceedings are handled by a single authority, thereby eliminating the complexity and duplication that would arise from dual It was envisioned that a taxpayer should not be compelled to respond to two different authorities for the same issue or transaction.

38. In the 5th GST Council Meeting held on 02.12.2016, the Chairman of the Council emphasized that for the effective implementation of the CGST and SGST, cross-empowerment was essential and should extend across the entire value chain of the taxpayer. The Minister from Karnataka observed that once the State administration had conducted the audit of a taxpayer, there was no justification for the matter to be transferred to the Central administration. The Secretary suggested that the functions such as issuance of show cause notices and passing of adjudication orders ought to be carried out by the same tax administration that had undertaken the audit, scrutiny, or enforcement, thereby maintaining continuity and administrative coherence. The Minister from Tamil Nadu expressed the view that, except in intelligence-based actions where both administrations were to be empowered, dual control should be avoided in other processes such as registration, return filing, scrutiny, audit, appeals, demand, and refund.

39. At the 9th GST Council Meeting held on 16.01.2017, the Chairman of the Central Board of Excise & Customs stated that the States had agreed that both the Central and State tax administrations shall have jurisdiction over the entire taxpayer base. He further emphasized that neither administration should be completely excluded from any segment of the value chain, so as to ensure proper checks and balances. Towards the conclusion of the discussion on the agenda of cross-empowerment, the Chairman noted that enforcement functions would remain common to both administrations. The Council accordingly agreed that both Central and State tax authorities would be empowered to undertake intelligence-based enforcement actions across the entire value chain of a taxpayer.

40. With a view to ensure single interface under the GST regime and to avoid dual control over taxpayers, the GST Council, in its 9th Meeting, resolved that a clear division of taxpayers between the Central and State tax administrations be effected for all administrative purposes. Simultaneously, the Council recognized the necessity of empowering both the Central and State tax administrations to act on intelligence-based enforcement actions across the entire value chain, regardless of administrative This dual empowerment was intended to maintain robust enforcement capabilities and prevent evasion, while preserving the administrative clarity of the single interface system.

41. To ensure cross-empowerment across the CGST, SGST, and IGST Acts, Section 6 was incorporated into the Sub-section (1) of Section 6 authorizes the officers appointed under the SGST Act or the Union Territory Goods and Services Tax Act (UTGST) to be “proper officer” for the purposes of the CGST Act. The State GST and Union Territory GST Acts also have similar provisions authorizing officers appointed under the CGST Act to be proper officers for the purposes of the respective State enactments. The provision reads thus:

“6. Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances.––(1) Without prejudice to the provisions of this Act, the officers appointed under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act are authorised to be the proper officers for the purposes of this Act, subject to such conditions as the Government shall, on the recommendations of the Council, by notification, specify.

- Subject to the conditions specified in the notification issued under sub-section (1),––

- where any proper officer issues an order under this Act, he shall also issue an order under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act, as authorised by the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act, as the case may be, under intimation to the jurisdictional officer of State tax or Union territory tax;

- where a proper officer under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act has initiated any proceedings on a subject matter, no proceedings shall be initiated by the proper officer under this Act on the same subject matter.

- Any proceedings for rectification, appeal and revision, wherever applicable, of any order passed by an officer appointed under this Act shall not lie before an officer appointed under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act.”

42. Section 6 of the CGST Act and the identical pari-materia provision in the respective State and Union Territories statutes, is a nuanced provision that enshrines both the concept as-well as the contours of “single interface” system and “cross-empowerment”. It delineates when and how the various officers appointed under different corresponding legislations shall act as “proper officer” for the purposes of the said Section 6 of the CGST Act has to be read with Circular No. 01/2017 dated 20.09.2017 and Circular dated 05.10.2018 read with Clarification F. No. CBEC-20/10/07/2019-GST dated 22.06.2020 by the Central Board of Indirect Taxes, GST Policy Wing.

43. In conformity with the scheme of cross-empowering officers, clause of sub-section (2) of Section 6 mandates that where a proper officer issues an order under the CGST Act, he has to pass an order under the SGST or UTGST Act respectively, under an intimation to the jurisdictional officer of the State and Union Territory tax authorities. Further, clause (b) of sub-section (2) bars a proper officer under the CGST Act to initiate proceedings on a subject matter where a proper officer under the SGST Act and UTGST Act has initiated proceedings on the same subject matter.

44. In furtherance of the Council’s decision regarding the administrative division of taxpayer base, the Circular No. 01/2017 dated 20.09.2017 was issued, laying down the framework for allocation of taxpayer between the Centre and the States.

“Subject: Guidelines for division of taxpayer base between the Centre and States to ensure Single Interface under GST – regarding

Based on the decisions taken in the 9th Meeting of the GST Council held on 16 January, 2017 and 21st Meeting of the GST Council held on 9 September, 2017, the following criteria should be followed for the division of taxpayer base between the Centre and the States to ensure single interface:

-

- Of the total number of taxpayers below 1.5 crore turnover, all administrative control over 90% of the taxpayers shall vest with the state tax administration and 10% with the Central tax administration; the state

- In respect of the total number of taxpayers above 1.5 crore turnover, all administrative control shall be divided equally in the ratio of 50% each for the Central and the State tax administration;

- The division of taxpayers in each State shall be done by computer at the State level based on stratified random sampling and could also take into account the geographical location and type of the taxpayers, as may be mutually agreed;[…]”

45. While the latter decision that both the Central and State tax administrations shall have power to take intelligence-based enforcement action in respect of the entire value chain is reflected in the Circular dated 05.10.2018, as reproduced above, and Clarification F. No. CBEC-20/10/07/2019-GST dated 22.06.2020 by the Central Board of Indirect Taxes, GST Policy Wing, which reads thus:

“To

The Principal Director General, Directorate General of GST Intelligence,

2nd Floor. Wing- VI, West Block- VIII R.K. Puram, New Delhi- 110066

Sir,

Subject: Reference form DGGI on Cross empowerment under GST. reg.

I am directed to refer to DGGI letter F.No.574/CE/66/2020/Inv./15308 dated 26.05.2020 on the issues related to cross empowerment of officers in terms of provisions of section 6 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as “the CGST Act”).

- Issue raised in the reference is whether intelligence based enforcement actions initiated by the Central Tax officers against those taxpayers which are assigned to the State Tax administration gets covered under section 6(1) of the CGST Act and the corresponding provisions of the SGST/UTGST Acts or whether a specific notification is required to be issued for cross empowerment on the same lines as notification No. 39/2017-CT dated 13.10.2017 authorizing the State Officers for the purpose or refunds under section 54 and 55 of the CGST Act.

3.1 The issue has been examined in the light of relevant legal provisions under the CGST Act, 2017. It is observed that Section 6 of the CGST Act provides for cross empowerment of State Tax officers and Central Tax officers and reads as:-

“6. (1) Without prejudice to the provisions of this Act, the officers appointed under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act are authorised to be the proper officers for the purposes- of this Act, Subject to such conditions as the Government shall, on the recommendations of the Council, by Notification specify.

3.2. Thus in terms of sub-section (1) of section 6 of the CGST Act and sub-section (1) of section 6 of the respective State GST Acts respective State Tax officers and the Central Tax officers respectively are authorised to be the proper officers for the purposes of respective Acts and no separate notification is required for exercising the said powers in this case by the Central Tax Officers under the provisions of the State GST Act. It is noteworthy in this context that the registered person in GST are registered under both the CGST Act and the respective SGST/UTGST Act.

3.3 The confusion seems to be arising from the fact that, the said sub-section provides for notification by the Government if such cross empowerment is to be subjected to conditions. It means that notification would be required only if any conditions are to be imposed. For example, Notification No. 39/2017-CT dated 13.10.2017 restricts powers of the State Tax officers for the purposes of refund and they have been specified as the proper officers only under section 54 and 55 of the CGST Act and not under rule 96 of the CGST Rules, 2017 (IGST Refund on exports). If no notification is issued to impose any condition, it means that the officers of State and Centre have been appointed as proper officer for all the purpose of the CGST Act and SGST Acts.

- Further, it may kindly be noted that a notification under section 6(1) of the CGST Act would be part of subordinate legislation which instead of empowering the officer under the Act, can only be used to impose conditions on the powers given to the officers by the section. In the absence or any such conditions, the power of Cross- empowerment under section 6(1) of the CGST Act is absolute and not conditional.

Yours faithfully, (Sumit Bhatia)

Deputy Commissioner (GST)”

46. The GST regime operates on the principle of self-assessment, as enshrined in Section 59 of the CGST Act, hence, all provisions are to be read in consonance, and not in derogation of Section 59. The provision reads thus:

“59. Self-assessment.—Every registered person shall self-assess the taxes payable under this Act and furnish a return for each tax period as specified under section 39.”

47. The concept of “cross-empowerment” has been retained within the GST framework in order to maintain a robust enforcement mechanism and prevent any scope of evasion of taxes. For this purpose, both the Central and State tax administrations have been armed with the power to initiate intelligence-based enforcement action e., an action that is predicated on information of tax evasion emanating from the value chain or chain of transactions rather than from any administrative scrutiny by way of audit of accounts or returns.

48. Such gathering of intelligence is intended to be a non-intrusive exercise. The Department relies on data analytics, validation with third-party data, and other methods to collect actionable intelligence via analytical tools, human intelligence, modus operandi alerts as well as information through past detections. Taxpayers must be mindful that intelligence about evasion of tax cannot be procured from them through issuance summons or other non-descript letters and correspondence.

49. Any action arising from the audit of accounts or detailed scrutiny of returns falls within the first category, and proceedings in such cases are to be initiated by the tax administration to which the taxpayer is assigned. In contrast, when proceedings are based on intelligence relating to tax evasion, they can be initiated by either the Central or the State tax administration.

50. To put simply, Section 6 of the CGST Act provides for the cross- empowerment of powers between the Central and State tax administrations. However, for the purpose of administrative convenience, the GST Council has sought to divide the taxpayer base between the two administrations through a circular. Nonetheless, with respect to intelligence-based enforcement actions, both the Central and the State tax authorities are empowered to act across the entire value chain.

51. We clarify with a view to obviate any confusion that, when we say intelligence-based enforcement action is any action that does not arise from audit of accounts or detailed scrutiny of returns, we do not for a moment say, that there is no scope for tax administration to undertake scrutiny of returns or audit of accounts. Both the Central and the State tax administration are well empowered to undertake such actions, as long as these actions are initiated on the basis of any intelligence relating to tax evasion.

52. The High Court of Delhi in the decision of Amit Gupta v. Union of India, reported in 2023 SCC OnLine Del 6664, succinctly interprets Section 6 of the CGST The relevant observations read thus:

“24. It is clear from Section 6(1) of the Act that it contains a non obstante clause and also empowers officers appointed under the State Goods and Services Tax Act, 2017 (hereafter “the SGST Act”) or the Union Territory Goods and Services Tax Act, 2017 (hereafter “the UGST Act”) to be appointed as proper officers for the purposes of the Act.

25. Clause (a) of sub-section (2) of Section 6 of the Act expressly provides that if a proper officer issues an order under Act, he shall also issue an order under the SGST Act or the UGST Act as authorised by the said enactments under intimation of the jurisdictional

26. In conformity with the scheme of statutes in respect of Goods and Services Tax Act (the Act, the SGST Act and the UGST Act) officers under any of the said statutes can be authorised as proper officers for the purposes of proceeding under the other GST statutes as Section 6(1) of the Act empowers the officers appointed under the SGST Act and the UGST Act to act as proper officers for the purposes of the Act. Section 6 of the SGST Act and the UGST Act mirrors Section 6 of the Act. Consequently, the officers under the said enactments are also authorised as proper officers under the Act.

27. In conformity with the scheme of cross- empowering officers under the said enactments, clause (a) of Section 6(2) of the Act also empowers a proper officer to issue orders under the SGST Act and the said Act. Similarly, officers under the SGST Act and the UGST Act are also empowered to issue orders under the Act. The only condition is that the issuance of such orders is required to be intimated to the jurisdictional officer of the central tax or the State tax, as the case may be.

28. To ensure that there are no multiple proceedings in regard of the central and the State officers being authorised as proper officers, clause (b) of Section 6(2) of the Act provides that where a proper officer under the SGST Act and the UGST Act has initiated proceedings on a subject-matter, the proper officer under the Act would not initiate proceedings “on the same subject-matter”. This provision of CGST is also mirrored by clause (b) of Section 6(2) of the SGST Act and UGST Act as well. Thus, where a proper officer under the CGST Act had initiated proceedings on a subject-matter, no proceedings would be initiated by proper officer authorised under the SGST Act or UGST Act on the same subject-matter.”

(Emphasis supplied)

53. At the cost of repetition, sub-section (1) of Section 6 stipulates the general power, encompassing both the single-interface mechanism and cross-empowerment, inasmuch as each “proper officer” may act as a proper officer under the SGST Act or the UTGST Act, and vice versa. Clause (a) of sub-section (2) further reinforces this by mandating that where a proper officer issues an order under the CGST Act, he must simultaneously pass a corresponding order under the SGST or UTGST Act, with due intimation to the jurisdictional officer of the State or Union Territory tax authorities. Clause (b) of sub-section (2) yet again affirms the principle of cross- empowerment, albeit operating within the narrower confines of intelligence-based enforcement action.

c. Scope and Ambit of “initiated any proceedings” under Section 6(2)(b) of the CGST Act

54. Before addressing what constitutes “proceedings” under Section 6(2)(b) of the CGST Act, it is apposite to first consider the petitioner’s contention that the phrase “any proceedings” is intended to encompass all proceedings initiated under the relevant GST enactments. We may reproduce the provision in discussion;

“(2) Subject to the conditions specified in the notification issued under sub-section (1),––

xxx

where a proper officer under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act has initiated any proceedings on a subject matter, no proceedings shall be initiated by the proper officer under this Act on the same subject matter.”

55. Section 6(2)(b) of the CGST Act precludes a proper officer under the CGST Act to initiate any proceedings on a subject matter if a proper officer under the SGST or the UGST Act has initiated any proceedings on the same subject matter. The CGST Act does not define the term “proceedings”. In context with this provision, the Chairman of the 11th GST Council Meeting, held on 04.03.2017, while discussing the approval of the Draft Central Goods and Services Tax Law, opined that that there should be an express or implied bar to prevent a taxpayer from being subjected to proceedings before multiple officers for the same dispute.

56. Section 70 of the CGST Act empowers a proper officer to summon any person whose presence is considered necessary for giving evidence or producing documents or any other relevant material in an inquiry. The issuance of summons is one of the instruments employed by the Department to obtain information, documents, or statements in cases involving suspected tax evasion. Such summons may be issued to the person under investigation or to a person considered a witness in investigation against another person.

57. A summons is not the culmination of an investigation, but merely a step in its course. It is in this context that the legislature has used the term “inquiry” in Section 70, as at the stage of issuing a summons, the Department is primarily engaged in gathering information regarding a possible contravention of law, which may subsequently form the basis for proceedings against an assessee. Since the objective is to collect information, the Department has, in certain instances, advised resorting to a letter of requisition in place of a formal summons.

58. At the stage of issuing a summons, the Department is yet to determine whether proceedings should be initiated against the assessee. Such evidence-gathering and inquiry do not constitute “proceedings” within the meaning of Section 6(2)(b) of the CGST The mere issuance of a summons cannot be equated with proceedings barred under the Act, as the subject matter cannot be ascertained solely through summons. That said, summons should not be issued in routine matters or for documents readily available on the GST portal. They ought to be issued after much thought and consideration as to the exact information required. We acknowledge that the issuance of multiple, cyclostyled summons may indicate a roving inquiry.

59. We affirm and appreciate the view taken by the High Court of Allahabad in K. Trading (supra) and the High Court of Kerala in K.T. Saidalavi (supra) respectively. The High Court of Allahabad rightly held that the issuance of summons cannot be conflated with a statutory step taken upon conclusion of an inquiry. Similarly, the High Court of Kerala was correct in holding that initiation of inquiry or the issuance of summons does not amount to the initiation of “any proceedings”. The phrase “initiation of any proceedings” refers specifically to the issuance of a notice under the relevant provisions of the GST enactment.

60. At this juncture, we wish to refer to the Guidelines on Issuance of Summons under Section 70 of the CGST Act issued by the Central Board of Indirect Taxes & Customs (GST – Investigation Wing) dated 17.08.2022. In view of the facts of the present case in hand, we would like to inject thrust into the Guidelines dated 08.2022, and direct the concerned Departments to adhere to the said Guidelines, in both letter and spirit.

61. In the present case, the petitioner was served with a show cause notice dated 18.11.2024 by the respondent no. 2 under Section 73 of the CGST Act, thereby initiating proceedings. The petitioner has impugned the summons dated 16.01.2025 and 23.01.2025 respectively issued by the respondent no. 1 for production of documents. At the summons stage, it cannot be predicated with certainty that the subject matter of the proceedings will be identical; the mere presence of an overlapping aspect under investigation does not ipso facto render the subject matter “same”.

62. The High Court correctly held that the term “any proceedings” does not encompass summons issued pursuant to a search or investigation, as at the stage of issuance of summons the Department is merely engaged in gathering information. We are in agreement with the finding that a case of search is clearly distinct and separate from proceedings initiated only after issuance of a show cause notice.

63. We may now proceed to elaborate on our understanding of “initiation of any proceedings” within the meaning of Section 6(2)(b) of the CGST Act. P. Ramanatha Aiyar’s, 6th Edition, page 4415-4420, defines “proceedings” as under:-

“It is not a technical expression with defined meaning attached to it but the one ambit of whose meaning will be governed by the statute. The word “proceedings” can be given a narrow or wide import depending upon the nature and scope of an enactment in which it is used and in the particular context of the language of the enactment in which it appears.”

(Emphasis supplied)

64. We may quote an extract from the Black’s Law Dictionary, 4th Edition, page 1368, it stated as under:-

“An act which is done by the authority or direction of the court, express or implied; an act necessary to be done in order to attain a given end; a prescribed mode of action for carrying into effect a legal right.”

65. A show cause notice is a document served on a noticee, requiring them to explain why a particular action should not be initiated against them. Under the GST regime, issuance of a show cause notice is a mandatory precondition for raising a It forms the bedrock for proceedings related to the recovery of tax, interest, and penalty. The notice ensures adherence to the principles of natural justice by granting the assessee an opportunity to present their case before any adverse action is taken. In essence, it serves as both a procedural safeguard and a legal necessity, marking the commencement of quasi-judicial adjudication under the Act.

66. A show cause notice sets the law in motion concerning the liability under the statute, containing charges that a specific person is called upon to answer. In other words, it sets out the alleged violations of legal provisions and requires the assessee to explain why the duty should not be recovered from them. Thus, a show cause notice cannot be vague, nor can any allegations be made without evidence being commensurate with the gravity of the charges levelled against the noticee.