Hearing Reports

Hearing Reports

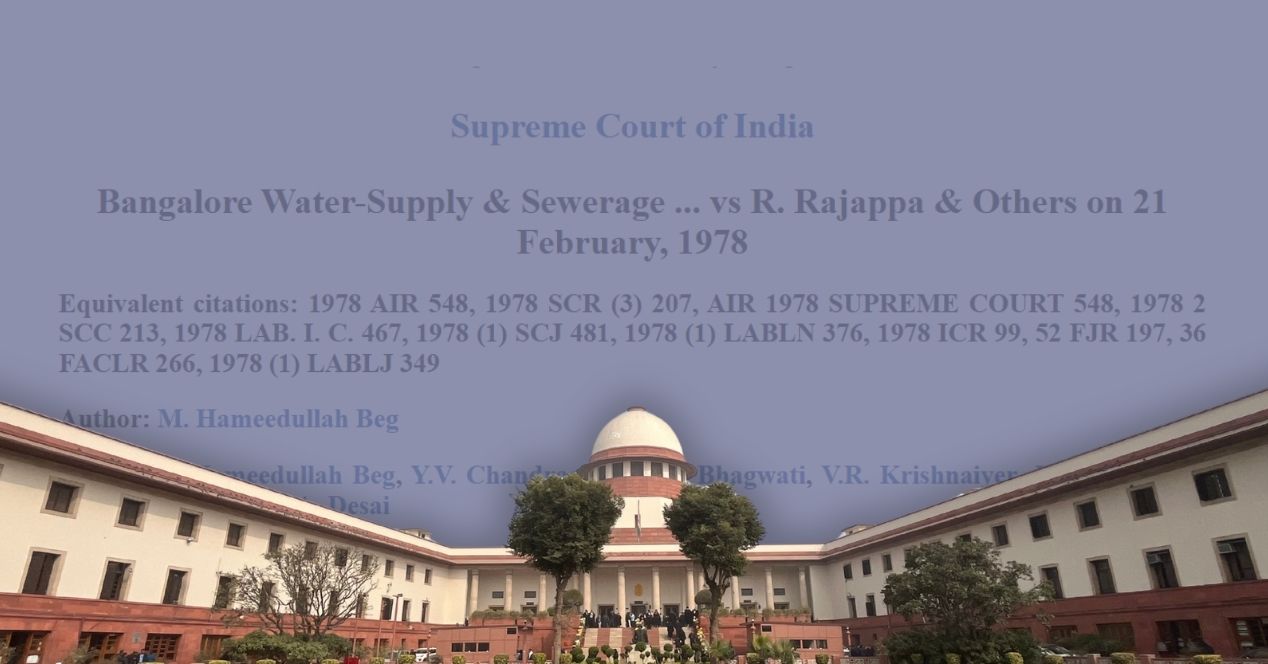

Definition of “Industry”| Judgement Summary

We summarise the 1978 judgement clarifying the meaning of "industry" under the Industrial Disputes Act, 1947

Hearing Reports

Maintainability of Sabarimala Review | Judgement Summary

A nine-judge bench upheld the review bench’s decision to refer substantial questions of law to a larger bench

Hearing Reports

West Bengal SIR | SC suggests deploying judicial officers from Jharkhand and Orissa

The Court noted that LD claims would be impossible to process without extra hands

Hearing Reports

West Bengal SIR | SC turns to Calcutta HC for adjudication of LD claims

The Bench observed that the SIR process was “stuck” and that its completion was the foremost concern

SCO Explains

Analysis

SCO.LR | 2026 | Volume 3 | Issue 2

With the Court on Holi break last week, this edition covers five bonus judgements from February 2026.

Analysis

Atomic risk

The Supreme Court heard a petition challenging India's new nuclear energy law just as the world confronted nuclear safety's stakes.

Mar 17, 2026

Definition of Industry | Day 1

Apr 7, 2026

Sabarimala Review | Day 1

May 5, 2026

Challenge to Citizenship Amendment Act, 2019 | Day 1

View allDefinition of “Industry”

Pending

State of Uttar Pradesh v Jai Bir Singh

A nine-judge Bench of the Supreme Court will reconsider its 1978 decision which gave a wide interpretation to the definition of 'industry' under the Industrial Disputes Act, 1947, leading to a higher standard of labour rights for more people..

Sabarimala Review

Pending

Kantaru Rajeevaru v Indian Young Lawyers’ Association

A nine-judge Constitution Bench will decide the correctness of a 2018 judgement which held that barring the entry of women in the Sabarimala Temple was unconstitutional

Citizenship Amendment Act

Pending

Indian Union Muslim League v Union of India

The Supreme Court will rule on the constitutionality of the Citizenship (Amendment) Act, 2019.

Featured

The SC on bail under UAPA and PMLA: a dataset from 2024 and 2025

As the Supreme Court considers the bail plea of Umar Khalid, here’s a ready-reckoner of relevant verdicts from the last couple of years

Spotlight

Seventy-Five years on: A Constitution still in negotiation

V. Krishna Ananth’s book argues that authoritative tools were a foundational compromise in the Constitution

Trending

Analysis

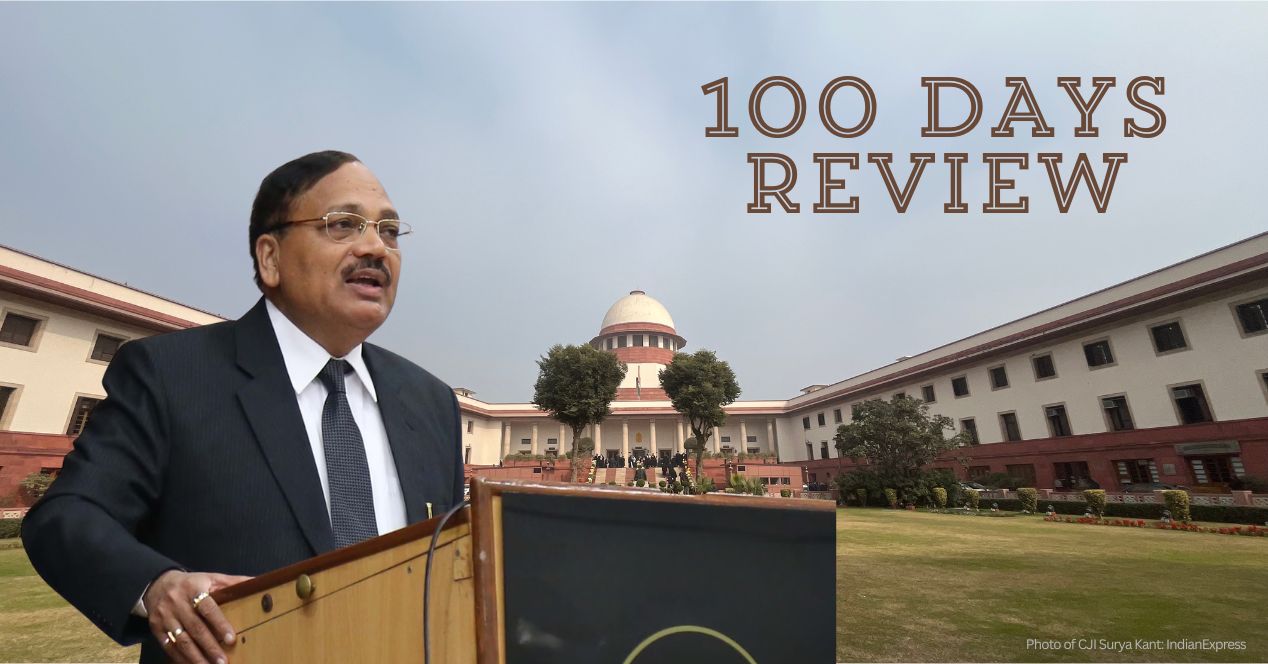

100 days of CJI Surya Kant

What was promised? What has been achieved? What can we expect? A brief look at the 53rd Chief Justice’s first 100 days.

Analysis

Supreme Court Review: Top 10 judgements of 2025

This year had it all: from a rare advisory opinion to intra-court reversals; from transgender rights to finer points on judge appointments

Analysis

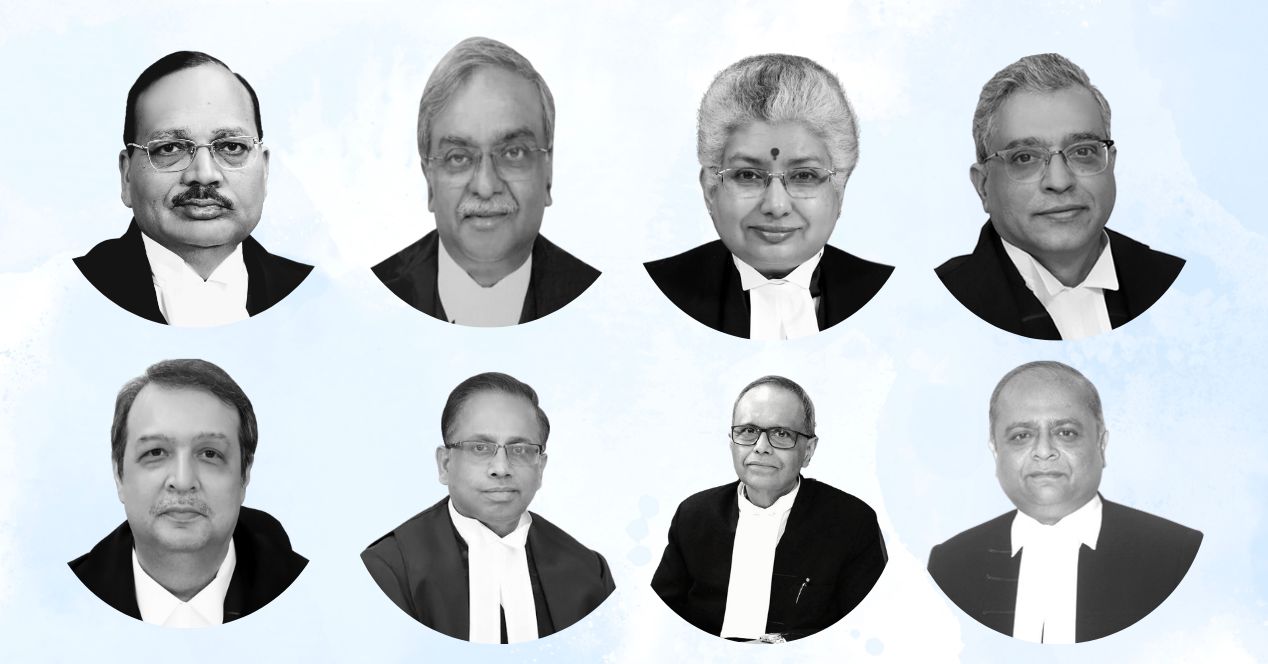

The next eight Chief Justices of India: 2025 to 2033

If the seniority principle is followed, these eight Judges will lead the Supreme Court of India as Chief Justice till 2033

Analysis

Supreme Court stays 2026 UGC equity regulations

Challenged for being “unfair” to general category students, the Bench found that the Regulations were prima facie vague and easy to misuse