Limitation for Entitlement to Disability Pension

Union of India v SGT Girish Kumar

Case Summary

The Supreme Court held that disability pension claims of ex-servicemen are deferred compensation for past service and are neither dependent upon the grace of the State, nor barred by limitation.

The respondent, an ex-military serviceman, was granted disability pension for life for suffering 20 per cent disability while in service....

Case Details

Judgement Date: 12 February 2026

Citations: 2026 INSC 149 | 2026 SCO.LR 2(3)[13]

Bench: P.S. Narasimha J, Alok Aradhe J

Keyphrases: Armed Forces Tribunal–Disability pension-Limitation period of three years–Union of India v Ram Avtar (2014)–Disability pension valuable right–Cannot be restricted by limitation.

Mind Map: View Mind Map

Judgement

ALOK ARADHE, J.

1. Leave granted.

2. These appeals, filed both by the Union of India and by Ex-servicemen, under Section 30 of the Armed Forces Tribunal Act, 2007 (‘Act’), arise out of conflicting decisions of the Armed Forces Tribunal (‘Tribunal’) concerning the period for which arrears of disability pension are payable. The Tribunal in certain cases directed payment of arrears of disability pension from specified cut-off dates, whereas, in others, restricted such benefits to 3 years prior to filing of the applications before the Tribunal. The present batch of appeals require this Court to determine whether entitlement to disability pension, once judicially affirmed, can be curtailed beyond a prescribed period by invoking limitation, delay or laches.

(i) FACTUAL MATRIX

3. For the sake of convenience, the facts in Civil Appeal Nos.6820-6824 of 2018 are noticed. The respondent in C.A. Nos.6820-6824 of 2018 was enrolled on 30.03.1988 in the Indian Air Force and was discharged on 31.03.2008 upon completion of tenure. At the time of discharge, he was assessed with disability attributable to and aggravated by military service at 20% for life and was granted disability pension accordingly. Pursuant to judgment rendered by a three-Judge Bench of this Court dated 10.12.2014 in Union of India & Others v. Ram Avtar1, the respondent approached the Tribunal on 20.10.2016 by filing an original application, seeking broad banding of disability pension to 50% along with arrears from the date of discharge. The Tribunal, by an order dated 13.12.2017, extended the benefit of broad banding of pension to the respondent from the date of his superannuation.

(ii) REFERENCE TO THE FULL BENCH OF THE TRIBUNAL

4. In view of the conflicting orders passed by the coordinate benches of the tribunal, on the issue regarding grant of arrears of disability pension beyond a period of three years, the same was referred for consideration to the larger bench of the tribunal. The full bench of the tribunal by an order dated 01.12.2017, inter alia held that the decision of this Court in Union of India & Others v. Ram Avtar (supra) is a judgment in rem and denial of arrears of disability pension amounts to deprivation of property. It was further held that disability pension is a recurring right and the right to claim the same cannot be denied either on the ground of limitation or delay or laches. It was also held that Section 22 of the Act does not apply to the fact situation of the case. Accordingly, the reference was answered.

5. The grievance of the Union of India in the appeals filed by it, is confined only to the direction to make payment of arrears of disability pension with effect from 01.01.1996 or 01.01.2006, as the case may be, without restriction of any time limit to claim arrears of disability pension. The ex-servicemen in their Civil Appeals claim the benefit of arrears of disability pension from the date of their retirement/discharge.

(iii) SUBMISSIONS

6. The learned Attorney General, appearing on behalf of the Union of India, submitted that the grievance of the Union is confined to the direction to pay arrears of disability pension beyond a period of three years. It was contended that claims for arrears of disability pension are governed by the provisions of the Limitation Act, 1963, as well as Section 22 of the Act, and that even in cases of continuing wrong, arrears cannot extend beyond the prescribed period of limitation. In support of the aforesaid submissions, reliance has been placed on the decisions of this Court2

7. Learned counsel appearing for the ex-servicemen, on the other hand, submitted that the right to claim arrears crystallised only upon the decision of this Court dated 10.12.2014, which is a judgment in rem. It was argued that denial or restriction of arrears of disability pension would amount to deprivation of a vested and recurring right, and that the issue is no longer res integra. In support of the aforesaid submissions, reliance has been placed on the decisions of this Court3 and decisions of the Tribunal4).

(iv) ISSUE FOR CONSIDERATION

8. The solitary issue which arises for consideration is whether the benefit of arrears of disability pension can be restricted to three years prior to filing of the original applications before the Tribunal.

(v) REASONS AND ANALYSIS

9. The statutory framework governing disability pension under the Pension Regulations for the Army, 1961 and the Pension Regulation for the Army, 2008, unequivocally recognises the entitlement of personnel retiring or discharged with disability attributable to or aggravated by military service to disability pension.

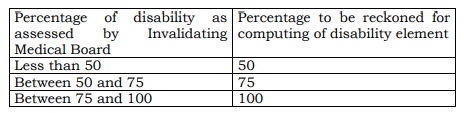

10. The Director (Pensions), Ministry of Defence, Government of India, issued instructions dated 31.01.2001 regarding the implementation of government decisions on the recommendations of the Fifth Central Pay Commission regarding disability pension/war injury pension / special family pension / liberalized family pension / dependent pension / liberalized dependent family pension for the Armed Forces Officers and Personnel below the rank retiring, invalidating or dying in harness on or after 01.01.1996. Para 7.2 of the aforesaid instructions provides that where an Armed Forces personnel is invalidated out under the circumstances mentioned in para 4.1, the extent of disability or functional incapacity shall be determined for the purposes of computing the disability element in the following manner: –

11. By a communication dated 20.07.2006 issued by Adjutant General’s Branch, integrated headquarters of Ministry of Defence (Army), removed the disability cap of 20% in respect of invalidment due to disability attributable to Military Service course after 01.01.1996. The Department of Ex-Servicemen Welfare, Ministry of Welfare, Government of India, addressed a letter dated 19.01.2010 to Chiefs of all the three services. The said letter states that on the basis of the recommendations made by the committee, it has been decided to extend the benefit of broad banding of percentage of disability/war injury as provided in para 7.2 of the instructions dated 31.01.2001 to all the officers and Armed Forces personnel who were invalidated out of service prior to 01.01.1996 and are in receipt of disability/war injury pension as on 01.07.2009. However, it was clarified that wherever the disability element/war injury element of pension in pre 01.01.1996 cases were not allowed for disability being accepted as less than 20% at the initial stage or subsequent stage on reassessment of the disability, the same will continue to be disallowed and such cases will not be reopened.

12. However, the instructions dated 31.01.2001 denied the benefit of broad banding of disability pension to ex-servicemen who superannuated from the services with disabilities. The validity of the aforesaid instructions insofar as it deprived the benefit of broad banding of disability pension to ex-servicemen was challenged before the Tribunal. The Tribunal by an order dated 04.08.2010 struck down the aforesaid instruction to the limited extent and held that ex-servicemen who superannuated with disabilities are also entitled to the benefit of broad banding of disability pension.

13. The validity of the orders passed by the Tribunal was challenged in batch of appeals. A three-Judge Bench of this Court in Union of India and Others v. Ram Avtar (supra), by an order dated 10.12.2014 dismissed more than 800 appeals filed by the Union of India challenging grant of broad banding of disability element by tribunals to Armed Forces Personnel other than ‘invalidated out’ from service. This Court ruled that an Armed Force Personnel retiring on completion of tenure with disability aggravated by or attributable to Military Service is eligible for broad banding of disability pension/element. This Court directed all the Courts and Tribunals to take note of the judgment and further directed Union of India to give effect to the orders passed by this Court within six weeks.

14. During the interregnum, between 31.01.2001 and 10.12.2014, the rights of disability pensioners remained in a state of suspension, the issue relating to broad banding of disability pension having not attained finality at the hands of this Court. The legal position continued to be uncertain until it was settled by a three-Judge bench of this Court in Union of India & Others v. Ram Avtar (supra). The judgment rendered on 10.12.2014 removed the impediment that had hitherto obstructed the exercise of the right of ex-servicemen, otherwise entitled, to seek broad banding of their disability pension.

15. Pension, as authoritatively settled by this Court, is neither a bounty nor an ex gratia payment dependent upon the grace of the State. It is a deferred portion of compensation for past service and, upon fulfilment of the governing conditions, matures into a vested and enforceable right. Pensionary entitlements, therefore, partake the character of property, and cannot be withheld, reduced, or extinguished except by authority of law5. This principle applies with full vigour to disability pension, which is grounded not merely in length of service, but in the impairment suffered by a member of the Armed Forces in the course of, or attributable to, the service rendered to the nation. The disability pension is not a matter of largesse, but a recognition of sacrifice made in service of the nation.

16. The Union of India, as a model employer, is expected to act with fairness, consistency and even-handedness in the administration of benefits conferred upon those who have served the nation. When a benefit is recognised by a policy and affirmed by judicial pronouncement, its application cannot be selective or uneven. The judgment rendered by a three-Judge Bench of this Court in Ram Avtar’s case (supra) was a judgment in rem and, therefore, the benefit of same ought to have been extended by Union of India to the eligible exservicemen instead of requiring them to file original applications before the Tribunal seeking their entitlement.

17. It is pertinent to note that the Union of India itself had taken a conscious policy decision to pay arrears of disability pension to all eligible ex-servicemen from 01.01.1996 or 01.01.2006, as the case may be. This position is clearly borne out from paragraph 2 of the letter dated 15.09.2014 issued by Deputy Secretary (Pension), Government of India, to Chiefs of Army, Navy and Air Force. The similar intent is also evident from paras 3 and 6 of the letter dated 10.10.2018 issued by Director, Department of Pension and Pensioner’s Welfare, Government of India, wherein civilian Medical Officers were granted revised disability benefit from 01.01.1996 or 01.01.2006.

18. The aforesaid communications reflect a conscious and deliberate policy choice on the part of Union of India to confer upon all eligible pensioners the benefit of arrears of disability pension with effect from 01.01.1996 or 01.01.2006, as the case may be. In view of decision of this Court in Ram Avtar (supra), the Government of India, by an order dated 18.04.2016, expressly conveyed its approval to the Chiefs of the Army, Navy and Air Force for implementation of the directions issued by the Courts and Tribunals granting the benefit of broad banding of the disability element to Armed Forces Personnel who had retired or were discharged on completion of engagement with disability, attributable to or aggravated by military service, from the date specified in the respective judicial orders.

19. The order dated 18.04.2016 was a conscious policy determination taken with full financial concurrence. Thus, where the State itself, by a conscious policy decision, has determined that arrears of disability pension are payable from a specified cut off date, it is not open to it to subsequently resile and contend that such arrears ought to be confined to a period of three years preceding the claim. To permit such a course, would amount to acknowledging the right in principle while denying its substantive content in effect. Any such deprivation of accrued arrears which has become due to ex-servicemen in view of judicial determination as well as policy decision taken by the Union of India itself, would constitute deprivation of property and would amount to infraction of Article 300A of the Constitution of India.

20. This Court has, in a consistent line of decisions6), recognised that right to receive disability pension is a valuable right and once found due, the benefit of the same has to be given from the date it became due. The same cannot be curtailed by restricting the benefit to a period of three years preceding the filing of the original application. In the absence of any compelling reason to take a different view, we find no justification to depart from the view consistently taken by this Court.

21. The contention advanced on behalf of the Union of India that the claim for arrears of disability pension is barred by Limitation Act, cannot be accepted. The issue with regard to broad banding of disability pension attained finality only on 10.12.2014. Thereafter, Union of India in the order dated 18.04.2016 addressed to Chiefs of Army, Navy and Air Force acknowledged in clear terms that arrears of disability pension were to flow from 01.01.1996 without any curtailment. Therefore, in the facts and circumstances of the case, the contention that the claims of ex-servicemen were barred by limitation does not deserve acceptance.

22. The reliance placed by the appellant on the decision of a two Judge Bench of this Court in Tarsem Singh (supra) is of no assistance to it, as the legal landscape did not remain static after decision in Tarsem Singh. Subsequently, a three-Judge Bench of this Court in Ram Avtar (supra), decided the issue of applicability of instruction dated 31.01.2001 and the aforesaid decision is in rem. For, yet another reason, the decision in Tarsem Singh (supra) has no application to the case in hand as ex-servicemen in the instant appeals are already in receipt of disability pension and are only seeking re-computation of the disability pension. The right to approach the Tribunal accrued to ex-servicemen only on 10.12.2014 i.e., when the decision in Ram Avtar (supra) was rendered by this Court. Therefore, the bar contained in Section 22(1)(c) of the Act has no application to the claims filed by the ex-servicemen before the Tribunal. In the facts and circumstances of the case, we find that the original applications filed by the ex-servicemen do not suffer from any delay or laches disentitling them from claiming the relief of arrears of disability pension. Thus, the objections founded on the delay and limitation are without any merit.

(vi) CONCLUSION

23. For the foregoing reasons, we do not find any merit in the appeals filed by the Union of India. Accordingly, the appeals filed by the Union of India are dismissed. The orders passed by the Tribunal which have been impugned in Civil appeals filed by the ex-servicemen i.e. in Civil Appeal Nos.8286-8287 of 2018, Civil Appeal No.1555 of 2024, Civil Appeal @ Diary No.34570 of 2019, Civil Appeal No.3091 of 2024 and Civil Appeal No.1724 of 2023, in so far as they restrict the benefit of arrears of disability pension to three years preceding the filing of original application are quashed and set aside. The appellants in the aforesaid appeals are held entitled to disability pension including the benefit of broad banding, due to them, with effect from 01.01.1996 or 01.01.2006, as the case may be, along with interest @ 6% per annum. Accordingly, the aforesaid appeals are allowed. Pending applications, if any, are disposed of.

24. There shall be no order as to costs.

- Union of India & Others. v. Ram Avtar, 2014 SCC Online SC 1761 [↩]

- Shri Madhav Laxman Vaikunthe v. State of Mysore, AIR 1962 SC 8; Anand Swarup Singh v. State of Punjab, (1972) 4 SCC 744; P.L. Shah v. Union of India & Anr. (1989) 1 SCC 546; M.R. Gupta v. Union of India & Ors. (1995) 5 SCC 628; Shiv Dass v. Union of India & Ors. (2007) 9 SCC 274; Union of India & Ors. v. Tarsem Singh (2008) 8 SCC 648; M. Siddiq (Ram Janmabhumi Temple case) v. Mahant Suresh Das & Ors. (2020) 1 SCC 1; P.K. Kapur v. Union of India & Ors. (2007) 9 SCC 425; State of Madhya Pradesh & Ors. v. Yogendra Shrivastava, (2010) 12 SCC 538; K.J.S. Buttar v. Union of India & Anr., (2011) 11 SCC 429; Asger Ibrahim Amin v. Life Insurance Corporation of India, (2016) 13 SCC 797; Davinder Singh v. Union of India & Ors., Civil Appeal No. 9946 of 2016 order dated 20.09.2016; and Union of India v. SGT Girish Kumar, Supreme Court Order dated 13.07.2018 in Civil Appeal Diary No.21811 of 2018. [↩]

- Order dated 01.09.2025 of Civil Appeal No.11311 of 2025 in Union of India & Ors. v. Reet MP Singh & Anr.; KJS Buttar v. Union of India (supra); Union of India v. Ram Avtar (supra); Ex Sigman Dharam Singh v. Union of India (Civil Appeal No.3882/2009); Davinder Singh v. Union of India (supra); Madan Prasad Sinha v. Union of India & Ors., (2019) 15 SCC 232; Union of India & Ors. v. Piyush Bahuguna (Order dated 25.03.2022 passed in Diary No.10713/2021) and Bijender Singh v. Union of India & Ors., 2025 SCC Online SC 895. [↩]

- Ram Avtar v. Union of India (Judgment dated 04.08.2010); Piyush Bahuguna v. Union of India (Judgment dated 10.10.2018) and Harbans Lal v. Union of India and Others (order dated 24.05.2018 in OA No.1789 of 2018 [↩]

- D.S. Nakara v Union of India, 1983 AIR SC 130, State of Jharkhand & Ors. v. Jitendra Kumar Srivastava & Anr., AIR 2013 SC 3383, Vijay Kumar v. Central Bank of India & Ors., 2025 INSC 848 [↩]

- K.J.S. Bhuttar v. Union of India & Anr., (supra); Davinder Singh v. Union of India & Ors. (supra); Madan Prasad Sinha v. Union of India & Ors., (supra); Piyush Bahuguna (Order dated 25.03.2022 passed in Diary No.10713/2021) and Bijender Singh v. Union of India (supra [↩]