Show-cause notice under the Competition Act, 2002

Competition Commission of India v Kerala Film Exhibitors Federation

Case Summary

The Supreme Court held that the Competition Act, 2002 does not mandate a second show-cause notice to an accused person when determining penalties. A single notice at the start of the proceedings is sufficient for the accused persons to respond.

Film distributors accused the Kerala Film Exhibitors Federation (KFEF) and its...

Case Details

Judgement Date: 26 September 2025

Citations: 2025 INSC 1167 | 2025 SCO.LR 9(5)[25]

Bench: Manoj Misra J, K.V. Viswanathan J

Keyphrases: Section 48 Competition Act, 2002—Liability of office bearers—anti-competitive agreements under Section 3—only single show-cause notice sent—COMPAT held notice to office bearers not sent—Supreme Court sets aside COMPAT Order—Held single notice sufficient—CCI order restored

Mind Map: View Mind Map

Judgement

1. An important question involving the interpretation of certain provisions of the Competition Act, 2002, (for short “the Act”) arises for consideration in this case.

2. The present statutory appeal, under Section 53T of the Act, has been filed against the judgment and order dated 19.04.2016 passed by the Competition Appellate Tribunal (for short the “COMPAT”). By the said judgment, the findings of the Competition Commission of India (for short the “Commission”) that Respondent No.1-Kerala Film Exhibitors Federation (for short the “KFEF”) acted in contravention of Section 3(1) read with Section 3(3)(b) of the Act and the penalty imposed on Respondent No.1 was upheld. The COMPAT set aside the penalty imposed on Respondent Nos.2 and 3 and also the directions which were in the nature of behavioural remedies, contained in clause (d) and (e) of para 9 of the order of the Commission. Aggrieved against that portion of the order of the COMPAT, the Commission is before us in appeal.

BRIEF FACTS: –

3. An information was filed by Respondent No.4-M/s Crown Theatre before the Commission alleging anti-competitive activities by Respondent No.1-KFEF and its office-bearers –Mr. P.V. Basheer Ahamed, President (Respondent No. 2), and Mr. M.C. Bobby, General Secretary (Respondent No. 3). The information was registered vide Case No.16 of 2014 and the gravamen of the allegation was that film distributors were threatened that their films would not be screened at the cinema halls belonging to members of Respondent No.1, if those distributors offered their films for exhibition at Crown Theatre- Informant (Respondent No.4). It was further alleged that KFEF (Respondent No.1) and Mr. Basheer Ahamed (Respondent No.2) took steps to ensure that whenever new Tamil and Malayalam movies were released, it would not be screened at Crown Theatre. KFEF (Respondent No.1) called for a strike/ban on exhibition of films by its members in their cinema halls. Respondent No.4-Crown Theatre even resigned from the membership of KFEF. In accordance with the provisions of the Act, vide order dated 08.05.2014, the Commission directed the Director General (DG) to investigate the matter. Specific direction was given to investigate the role of the persons who were in charge of KFEF for their conduct with respect to the affairs of the Federation.

REPORT OF THE DIRECTOR GENERAL: –

4. The Director General, pursuant to the order passed by the Commission, investigated the matter and submitted his report dated 22.05.2015. According to the appellant, after collecting various incriminating materials which pointed to the role of Respondent Nos. 2 and 3 herein, the DG, in his report, made specific references to the same and highlighted their personal involvement in the anti- competitive measures undertaken by Respondent No.1. According to the appellant, the evidence and material showed that Respondent Nos.2 and 3 played an active role in anti-competitive activities of Respondent No.1-KFEF. It, in fact, has been claimed that there was not even a denial on the said score.

5. The DG concluded that Respondent No.1-KFEF contravened Section 3(3) of the Act and particularly its decision to boycott distributors if they had dealings with Respondent No.4-Crown Theatre, was anti-competitive causing appreciable adverse effect on competition. Respondent Nos.2 and 3 were described as key persons/key decision makers who played an active role in Respondent No.1 (KFEF), in Chapter 6 of the Report titled “Role and liability of office-bearers.”

NOTICE TO PARTIES BY THE COMMISSION: –

6. The Commission, by its order of 10.06.2015, upon consideration of the DG Report decided to forward a copy of the report, apart from Respondent No.1, to Mr. Basheer Ahamed (Respondent No.2), and Mr. M.C. Bobby (Respondent No.3), who were the President and the General Secretary of the KFEF (Respondent No.1) respectively, with a direction that the parties, including the individuals file their replies. Not only this, Respondent No.1 and the individuals were directed to furnish their audited balance sheet and profit and loss account for F.Y. 2011-12, 2012-13 and 2013-14 on or before 14.07.2015. Parties were further directed to appear before the Commission for oral hearing on 22.07.2015. A notice came to be issued on 10.06.2015, in terms of the order of the Commission.

PROCEEDINGS BEFORE COMMISSION AND ORDER: –

7. The Commission heard the parties on their objections. The three respondents were represented by common counsel who was heard by the Commission. The Commission passed its final order on 08.09.2015 under Section 27 of the Act. The Commission found that KFEF (Respondent No.1) had violated Section 3(3)(b) of the Act, and Respondent Nos.2 and 3, being the President and the General Secretary of Respondent No.1, were found to be in charge of the affairs of KFEF, liable under Section 48.

The relevant portion of the Commission order dated 08.09.2015 is set out herein below:-

“6.10 In view of the foregoing, the Commission is of the view that the conduct of OP amounts to contravention of section 3(1) read with section 3(3)(b) of the Act.

6.11 With regard to the liability of the office bearers of OP under section 48 of the Act, the DG has identified Basheer Ahmed and Mr. M. C. Bobby, President and General Secretary of OP, respectively, to be the key decision makers of OP. Section 48(1) of the Act provides that where a person committing contravention of any of the provisions of this Act is a company (including a firm or an association), every person who, at the time the contravention was committed, was in charge of, and was responsible for the conduct of the business of the company/association, shall be deemed to be guilty of the contravention and shall be liable to be proceeded against and punished accordingly. Further the proviso to that sub- section entails that such person shall not be liable to any punishment if he proves that the contravention was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such contravention. As such the Commission notes that Mr. Basheer Ahmed and Mr. M.C. Bobby, being the President and General Secretary of OP, respectively, are responsible for the conduct of OP. It is evident that they were involved in the key decisions of OP. Mr. Mukesh Mehta of M/s E4 Entertainment had also categorically stated he was directed by Mr. Basheer Ahmed over the phone to stop providing Tamil movies to the Informant. As a result, a movie namely, “Raja Rani” which was released at the Informant’s theatre was taken down after three days. As such, it is evident that Mr. Basheer Ahmed played an active role in enforcing the directives of OP in controlling and restricting the exhibition of new movies across Kerala. Further, Mr. M.C. Bobby, General Secretary of OP, is also responsible for the conduct of OP being in a key position. Moreover, in spite of ample opportunity given to them, they failed to adduce any evidence to establish that the anti-competitive decisions were made without their knowledge or that they had exercised all due diligence to prevent their commissioning.

6.12 In view of the foregoing, the Commission is of the view that both Mr. Basheer Ahmed and M.С. Bobby, being in-charge of and responsible for the conduct of business of OP under section 48 of the Act, are liable to be penalised.

6.13 It is relevant to mention that in Case no. 45/2012, Kerala Cine Exhibitors Association Kerala Film Exhibitors Federation and Others, the Commission had already found these two office bearers responsible under section 48 of the Act and imposed a penalty @ 7% of their average income accordingly.

ORDER

7. Considering the findings elucidated in the earlier part of this order, the Commission finds that OP has indulged in anti-competitive conduct in violation of the provisions of section 3 of the Act. Further, two of its office bearers, namely, Mr. P.V. Basheer Ahmed and Mr. M.C. Bobby have continued with the said anti-competitive conduct despite the on-going investigation by the DG in Case no. 45 of 2012. It is thus clear that these persons have been repeatedly indulging in anti-competitive conduct to the detriment of competition in the market.

8. Section 27 of the Act empowers the Commission to pass all or any of the orders enumerated therein, and issue such other order or direction as it may deem fit in case of contravention of the provisions of section 3 or 4 of the Act. Further, in case of an anti-competitive conduct committed by a company, including a firm or other association of individuals, the Commission may proceed under section 48 of the Act to penalise the individuals responsible for the anti- competitive conduct on the part of such company. The Commission observes that OP has been penalised in Case no. 45/2012, Kerala Cine Exhibitors Association vs. Kerala Film Exhibitors Federation and Others for indulging in anti-competitive conduct which was of similar nature. Further, in various earlier cases pertaining to anti- competitive conduct by film associations, this Commission has taken a stern view that such activities are antithetic to competition and fair-play in the market.

9. With regard to the penalty, it may be noted that the objective of imposing a penalty under section 27 of the Act is two-fold. Firstly, to discipline the erring party for its anti- competitive conduct and, secondly, as a deterrence to stall future contraventions. Such deterrence is not only for the concerned erring entity which has been found guilty of contravention, but also for all other entities which are operating under similar circumstances and are indulging in similar anti-competitive conduct. As spelt out earlier, in numerous cases pertaining to anti-competitive conduct by film associations, the Commission has imposed heavy financial penalties. As a matter of record, information in one such case was filed by the present OP against Film Distributors Association, Kerala. Further, the allegations against the anti-competitive conduct by OP was first reported to the Commission in mid-2012 in Case no. 45 of 2012 wherein the Commission directed the DG to initiate an investigation vide its prima facie order 09.01.2013. The Commission was seized of the matter in Case no. 45 of 2012 when OP further indulged in the similar anti-competitive conduct. However, it appears that OP has turned a blind eye to the past orders of the Commission against like film associations in other states for similar anti-competitive conduct as well as the on-going investigation against it in Case No. 45 of 2012. In view of these, the Commission issues the following directions under section 27 of the Act:

a. OP and its office bearers, namely, Mr. P.V. Basheer Ahmed and Mr. M.C. Bobby shall immediately cease and desist from indulging in anti-competitive conduct which they have been found to be indulging in contravention of section 3 of the Act, as explained in earlier paragraphs. This shall come into effect immediately, i.e., on the day of receipt of this order by them.

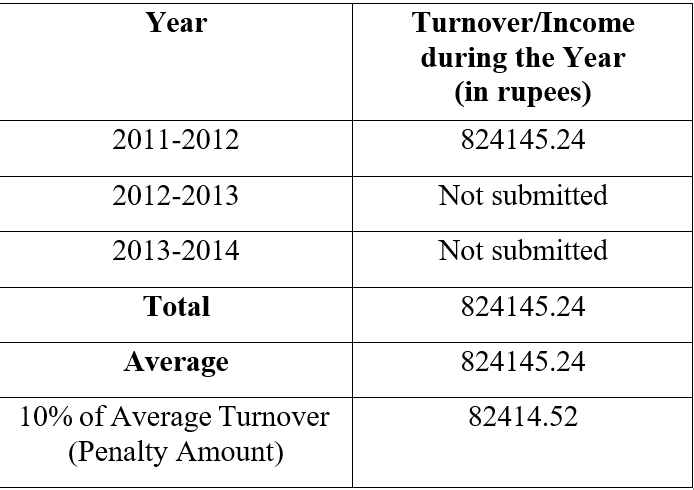

b. OP shall pay penalties as worked out hereunder and deposit the penalties calculated at the rate of 10% of its average income within 60 days from the receipt of the order by them:

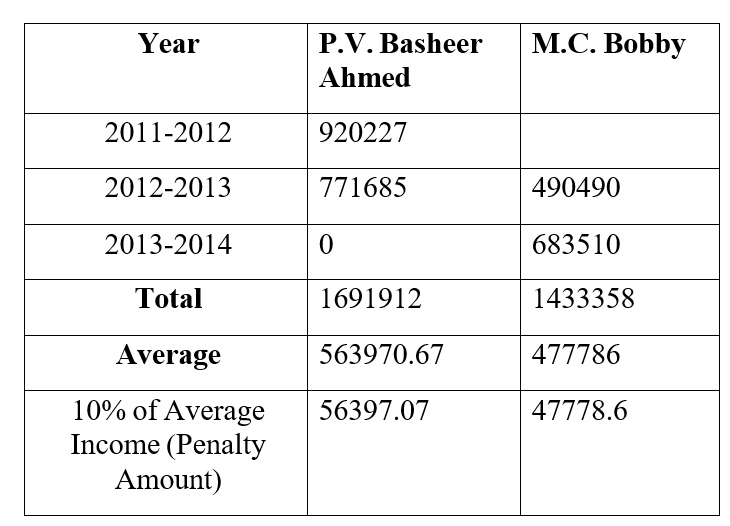

c. Further, Mr. P.V. Basheer Ahmed and Mr. M.С. Bobby shall pay penalties calculated at the rate of 10% of their average income as worked out hereunder and deposit the penalties within 60 days from the receipt of the order by them:

d. OP shall not associate Mr. P.V. Basheer Ahmed and Mr. M.C. Bobby with its affairs, including administration, management and governance, in any manner for a period of two years. This shall be complied with before expiry of 60 days from the receipt of the order by OP.

e. Mr. P.V. Basheer Ahmed and Mr. M.C. Bobby shall not associate with OP, including its administration, management and governance, in any manner for a period of two years. This shall be complied with before expiry of 60 days from the receipt of the order by them.

f. OP shall organize, in letter and spirit, at least five competition awareness and compliance programmes over next six months in the State of Kerala for its members. The compliance of this shall commence before expiry of 60 days from the receipt of the order by OP.

10. The OP and the office bearers of the OP, namely, Mr. P.V. Basheer Ahmed and Mr. M.C. Bobby shall file with the Commission a report of compliance each with the above directions, pertaining to them, within 90 days of receipt of this order by them.

11. Secretary is directed to inform the parties accordingly.”

(Emphasis supplied)

APPELLATE PROCEEDINGS : –

8. The three respondents filed a common appeal before the erstwhile COMPAT being Appeal No. 99 of 2015 against the order of the Commission dated 08.09.2015. By virtue of the impugned order dated 19.04.2016, the COMPAT, while upholding the findings on merits, set aside the penalty and directions only insofar as Mr. Basheer Ahamed (Respondent No.2) and Mr. M.C. Bobby (Respondent No.3) were concerned. The reasoning of the COMPAT on this score is as follows:-

20. A reading of the investigation report shows that on receipt of order dated 08.05.2014 passed by the Commission under Section 26(1), the Addl. DG issued notice to Appellant No. 1 under Section 41(2) read with Section 36(2) to enable it to explain its stand viz. a viz. the allegations contained in the information. He also issued summons to various persons and recorded their statements. Not only this, he confronted Appellant No. 2 with the statements/affidavits of Shri Mukesh R. Mehta, Ms. Sandra Thomas and Shri Lal Jose to enable him to admit/deny and to explain the position of Appellant No. 1. Not only this, he confronted Appellant No. 2 with the statements made by the representative of Respondent No. 2 and various film distributors and gave opportunity to him to explain the same. After recording the statements and considering the material collected during investigation, the Addl. DG submitted report with the finding that Appellant No. 1 had acted in contravention of Section 3(1) read with Section 3(3)(b) of the Act.

21. We have minutely gone through the statements of Shri Roopesh G. Makhija, Manager of R.M. Films, Shri Mukesh R. Mehta (Proprietor of M/s. E4 Entertainment), Ms. Sandra Thomas (Managing Director of M/s. Friday Ticket) and others along with the explanation given by Appellant No. 2 when he was confronted with the statements of these persons and are convinced that Appellant No. 1 had directly/indirectly pressurized the film distributors not to release the films to Respondent No. 2 or withdraw the film already released because it refused to participate in the agitation held under the aegis of Appellant No. 1 in 2012 and also resigned from its membership.

The findings recorded by the Addl. DG, which have been approved by the Commission by independently taking cognizance of the statements made by the persons to whom summons were issued, are based on a comprehensive analysis of the evidence collected by him and we do not find any error either procedural or substantive in the investigation conducted by the Addl. DG and the findings/conclusion recorded by him. On its part, the Commission independently considered the statements of three of the persons who were summoned by the Addl. DG and agreed with the conclusion recorded by the Addl. DG that the conduct of Appellant No. 1 was contrary to Section 3(1) read with Section 3(3)(b). The view taken by the Commission is quite plausible and reasonable and the findings recorded by it do not suffer from any such legal infirmity which may call for interference under Section 53-B(2) of the Act.

22. We shall now consider whether the penalty imposed by the Commission on Appellants Nos. 2 and 3 and the directions given that Appellant No. 1 shall not associate them with its affairs including administrative, management and governance in any manner for a period of two years and the corresponding directions given to Appellants Nos. 2 and 3 are legally sustainable.

23. The admitted factual matrix of the case shows that after considering the information filed by Respondent No. 2 under Section 19(1)(a) of the Act, the Commission ordered an investigation against Appellant No. 1. The Addl. DG conducted investigation and returned a finding that the conduct of Appellant No. 1 was in contravention of Section 3(1) read with Section 3(3)(b). In Chapter 6 of his report, the Addl. DG discussed the role of Appellants Nos. 2 and 3 and opined that they were the key decision-makers on behalf of Appellant No. 1 and that they were instrumental in anti- competitive activities of Appellant No. 1. These findings were recorded by the Addl. DG without issuing notice to Appellants Nos. 2 and 3 that on the basis of the material collected during the investigation, he proposes to make observations adverse to their conduct. The Commission also did not issue any notice to Appellants Nos. 2 and 3 proposing to debar them from discharging the functions as important functionaries of Appellant No. 1.

24. No doubt, under Section 27(g), the Commission is vested with omnibus powers to pass such other order or issue such direction as it may deem fit, but that power has to be exercised in consonance with the principles of natural justice which the Commission bound to comply with in view of Section 36(1) of the Act.

25. Admittedly, no notice was given by the Commission to Appellants Nos. 2 and 3 proposing to impose penalty on them and to debar them from participating in the affairs of Appellant No. 1 and no opportunity of hearing was afforded to them to represent their cause. Thus, there is no escape from the conclusion that the directions contained in Clauses (d) and (e) of paragraph 9 of the impugned order are vitiated due to violation of the principles of natural justice and the same are liable to be quashed.

26. In the result, the appeal is partly allowed. The finding recorded by the Commission that Appellant No. 1 has acted in contravention of Section 3(1) read with Section 3(3)(b) and penalty imposed on it is upheld. However, the penalty imposed on Appellants Nos. 2 and 3 as also directions contained in Clauses (d) and (e) of paragraph 9 of the impugned order are set aside”.

(Emphasis supplied)

9. Aggrieved by that portion of the order setting aside the penalty and directions on the ground that no opportunity of hearing was afforded to Respondent Nos.2 and 3, the appellant is before us in appeal.

CONTENTIONS OF LEARNED COUNSEL: –

10. We have heard Mr. Arjun Krishnan, learned counsel for the appellant-Commission and Mr. Harshad V. Hameed, learned counsel for the Respondent Nos. 1 to 3.

11. Mr. Arjun Krishnan, learned counsel for the appellant- Commission, who very ably presented the case submitted that Respondent Nos. 2 and 3 being the President and the General Secretary of Respondent No.1 (KFEF) are, by virtue of the office held by them, responsible for the affairs of the Federation. The use of the phrase “key persons” and “key decision makers”, while referring to Respondent Nos.2 and 3 in the DG Report itself, clearly indicates that they were in charge of and responsible. Alternatively, it is argued by Mr. Arjun Krishnan, learned counsel, that in view of the anti- competitive conduct, consent and connivance of Respondent Nos.2 and 3 with Respondent No.1 is clearly attracted. Learned counsel contends that Respondent Nos.2 and 3 are covered either under Section 48(1) of the Act and, if not, definitely under Section 48(2) of the Act. Learned counsel contends that in the absence of any challenge to the order of the COMPAT on merits, those findings have attained finality. Learned counsel contends that the Act did not contemplate a two-stage procedure, namely, one for liability and another for imposing penalty. According to the learned counsel, the COMPAT committed a serious error in setting aside the penalty and directions against Respondent Nos.2 and 3 on the erroneous ground that no notice was issued to them. According to the learned counsel, the scheme of the Act contemplates a single hearing. Learned counsel, to buttress the submission, argued that what is contemplated is a reasonable opportunity of hearing and that there is no obligation to inform the proposed penalty to Respondent Nos.2 and 3. Adequate opportunity was given to Respondent Nos.2 and 3 when the DG Report was furnished to them and their comments were called for. Learned counsel draws attention to the appellant-Commission calling for the Income Tax Returns of Respondent Nos.2 and 3 to reinforce his submission. Learned counsel adverted to the conduct of Respondent Nos.2 and 3 in an earlier proceeding being Case No. 45 of 2012 to show the consistent course of anti-competitive conduct by them. Learned counsel relied on certain authorities in support of his proposition.

12. Learned counsel contended that the impugned order of COMPAT deserves to be set aside. Alternatively, it was contended that there was no justification for setting aside the monetary penalty imposed on Respondent Nos.2 and 3.

13. Refuting the submissions of the appellant, equally ably, Mr. Harshad V. Hameed, learned counsel for Respondent Nos. 1, 2 and 3 contended that the COMPAT was justified in passing the order. According to the learned counsel, regulatory authorities ought to provide adequate notice and opportunity before imposing penalties failing which their orders would be vulnerable on the ground of violation of principles of natural justice.

14. According to the learned counsel, merely supplying a copy of the DG Report did not constitute sufficient notice for the purpose of imposing penalty. Learned counsel contends that a specific show cause notice addressing the proposed penalty as the office-bearers was required to be issued to Respondent Nos.2 and 3. According to the learned counsel, making office-bearers personally responsible for decisions collectively taken by bodies would “cripple and fetter” if not altogether take way the right to form associations, a guaranteed fundamental right under Article 19 of the Constitution of India. Learned counsel contended that penalty, in any event, is disproportionate. So contending, learned counsel vehemently defended the order of the COMPAT.

QUESTION FOR CONSIDERATION: –

15. In the above background, the question that arises for consideration is whether the notice issued by the appellant to Respondent Nos.2 and 3 on 10.06.2015, constitutes sufficient notice and/or whether the Respondent Nos. 2 and 3 were entitled to a second show cause notice proposing to impose the penalty under Section 27 of the Act?

ANALYSIS AND REASONS: –

SURVEY OF THE RELEVANT PROVISIONS OF THE STATUTE

16. As the preamble to the Act indicates, the Act was enacted to provide, keeping in view the economic development of the country, the establishment of a Commission to prevent practices having adverse effect on competition; to promote and sustain competition in markets; to protect the interests of consumers and to ensure freedom of trade carried on by other participants in markets, in India, and for matters connected therewith and incidental thereto. The precursor to the Act was the Monopolies and Restrictive Trade Practices Act, 1969 (for short “the MRTP Act”). The MRTP Act had become obsolete in certain respects in the light of international economic developments and there was a felt need to shift the focus from curbing monopolies to promoting competition.

17. A High-Level Committee on Competition Policy and Law was constituted by the Central Government and the Committee submitted its report on 22.05.2000. The Act established a quasi-judicial body called the Competition Commission of India which was to undertake competition advocacy for creating awareness and imparting training on competition issues. The Act aimed at curbing negative aspects of competition through the medium of Commission. The Commission was to look into violations of the Act based on its own knowledge or information or complaints received and references received by the Central Government, the State Governments or statutory authorities. The Commission was empowered to pass orders for granting interim relief or any other appropriate relief and compensation or to pass orders imposing penalties. An appeal was to lie to the Competition Appellate Tribunal. Originally, the Act proposed an appeal to the Supreme Court directly. However, thereafter an appeal was provided by Section 53A to the COMPAT. Since 26.05.2017, the National Company Law Appellate Tribunal (for short “NCLAT”) was designated as the Appellate Tribunal for matters arising out of the area of the Commission.

18. The Act provides for investigation by the DG on directions issued by the Commission. The Act empowers the Commission to impose penalties. For the purpose of the present case, we need to briefly refer to Section 3 which deals with anti-competitive agreements; Section 4 which deals with abuse of dominant position; Section 19 which speaks of inquiry into certain agreements and dominant position of enterprise; Section 26 which talks of procedure for inquiry under Section 19; Section 27 which provides for order by Commission after inquiry into agreements or abuse of dominant position; Section 28 which speaks of division of enterprise enjoying dominant position, and Section 48 which deals with contravention by companies (which definition was to include a body corporate, a firm or other association of individuals).

19. Section 48 deals with how every person who, at the time of the contravention was in charge of, and was responsible to the company was to be deemed in contravention of the Act and as to how the Commission was empowered to impose penalty on such persons as it may deem fit which shall not be more than 10% of the average income for the last preceding three years.

20. In this background, we deem it appropriate to set out Sections 26, 27, 36, 48 of the Act and Regulation 21, 22 and 48 of the Competition Commission of India (General) Regulations, 2009, as it then stood.

“26. Procedure for inquiry under section 19.—

(1) On receipt of a reference from the Central Government or a State Government or a statutory authority or on its own knowledge or information received under section 19, if the Commission is of the opinion that there exists a prima facie case, it shall direct the Director General to cause an investigation to be made into the matter:

Provided that if the subject matter of an information received is, in the opinion of the Commission, substantially the same as or has been covered by any previous information received, then the new information may be clubbed with the previous information.

(2) Where on receipt of a reference from the Central Government or a State Government or a statutory authority or information received under section 19, the Commission is of the opinion that there exists no prima facie case, it shall close the matter forthwith and pass such orders as it deems fit and send a copy of its order to the Central Government or the State Government or the statutory authority or the parties concerned, as the case may be.

(3) The Director General shall, on receipt of direction under sub- section (1), submit a report on his findings within such period as may be specified by the Commission.

(4) The Commission may forward a copy of the report referred to in sub-section (3) to the parties concerned:

Provided that in case the investigation is caused to be made based on a reference received from the Central Government or the State Government or the statutory authority, the Commission shall forward a copy of the report referred to in sub-section (3) to the Central Government or the State Government or the statutory authority, as the case may be.

(5) If the report of the Director General referred to in sub-section

(3) recommends that there is no contravention of the provisions of this Act, the Commission shall invite objections or suggestions from the Central Government or the State Government or the statutory authority or the parties concerned, as the case may be, on such report of the Director General.

(6) If, after consideration of the objections or suggestions referred to in sub-section (5), if any, the Commission agrees with the recommendation of the Director General, it shall close the matter forthwith and pass such orders as it deems fit and communicate its order to the Central Government or the State Government or the statutory authority or the parties concerned, as the case may be.

(7) If, after consideration of the objections or suggestions referred to in sub-section (5), if any, the Commission is of the opinion that further investigation is called for, it may direct further investigation in the matter by the Director General or cause further inquiry to be made in the matter or itself proceed with further inquiry in the matter in accordance with the provisions of this Act.

(8) If the report of the Director General referred to in sub-section (3) recommends that there is contravention of any of the provisions of this Act, and the Commission is of the opinion that further inquiry is called for, it shall inquire into such contravention in accordance with the provisions of this Act.

27. Orders by Commission after inquiry into agreements or abuse of dominant position.- Where after inquiry the Commission finds that any agreement referred to in section 3 or action of an enterprise in a dominant position, is in contravention of section 3 or section 4, as the case may be, it may pass all or any of the following orders, namely:—

(a) direct any enterprise or association of enterprises or person or association of persons, as the case may be, involved in such agreement, or abuse of dominant position, to discontinue and not to re-enter such agreement or discontinue such abuse of dominant position, as the case may be;

(b) impose such penalty, as it may deem fit which shall be not more than ten percent of the average of the turnover for the last three preceding financial years, upon each of such person or enterprises which are parties to such agreements or abuse:

[Provided that in case any agreement referred to in section 3 has been entered into by a cartel, the Commission may impose upon each producer, seller,

distributor, trader or service provider included in that cartel, a penalty of up to three times of its profit for each year of the continuance of such agreement or ten per cent of its turnover for each year of the continuance of such agreement, whichever is higher.

* * *

(d) direct that the agreements shall stand modified to the extent and in the manner as may be specified in the order by the Commission;

(e) direct the enterprises concerned to abide by such other orders as the Commission may pass and comply with the directions, including payment of costs, if any;

* * *

(g) pass such other order or issue such directions as it may deem fit: –

Provided that while passing orders under this section, if the Commission comes to a finding, that an enterprise in contravention to section 3 or section 4 of the Act is a member of a group as defined in clause (b) of the Explanation to section 5 of the Act, and other members of such a group are also responsible for, or have contributed to, such a contravention, then it may pass orders, under this section, against such members of the group.

36. Power of Commission to regulate its own procedure

(1) In the discharge of its functions, the Commission shall be guided by the principles of natural justice and, subject to the other provisions of this Act and of any rules made by the Central Government, the Commission shall have the powers to regulate its own procedure.

(2) The Commission shall have, for the purposes of discharging its functions under this Act, the same powers as are vested in a Civil Court under the Code of Civil Procedure, 1908 (5 of 1908), while trying a suit, in respect of the following matters, namely:-

(a) summoning and enforcing the attendance of any person and examining him on oath;

(b) requiring the discovery and production of documents;

(c) receiving evidence on affidavit;

(d) issuing commissions for the examination of witnesses or documents;

(e) requisitioning, subject to the provisions of sections 123 and 124 of the Indian Evidence Act, 1872 (1 of 1872), any public record or document or copy of such record or document from any office.

(3) The Commission may call upon such experts, from the fields of economics, commerce, accountancy, international trade or from any other discipline as it deems necessary to assist the Commission in the conduct of any inquiry by it.

(4) The Commission may direct any person-

(a) to produce before the Director General or the Secretary or an officer authorized by it, such books or other documents in the custody or under the control of such person so directed as may be specified or described in the direction, being documents relating to any trade, the examination of which may be required for the purposes of this Act;

(b) to furnish to the Director General or the Secretary or any other officer authorized by it, as respects the trade or such other information as may be in his possession in relation to the trade carried on by such person as may be required for the purposes of this Act.

48. Contravention by companies.

(1) Where a person committing contravention of any of the provisions of this Act or of any rule, regulation, order made or direction issued thereunder is a company, every person who, at the time the contravention was committed, was in charge of, and was responsible to the company for the conduct of the business of the company, as well as the company, shall be deemed to be guilty of the contravention and shall be liable to be proceeded against and punished accordingly:

Provided that nothing contained in this sub-section shall render any such person liable to any punishment if he proves that the contravention was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such contravention.

(2) Notwithstanding anything contained in sub-section (1), where a contravention of any of the provisions of this Act, or of any rule, regulation, order made or direction issued thereunder has been committed by a company and it is proved that the contravention has taken place with the consent or connivance of, or is attributable to any neglect on the part of, any director, manager, secretary or other officer of the company, such director, manager, secretary or other officer shall also be deemed to be guilty of that contravention and shall be liable to be proceeded against and punished accordingly.

Explanation.—For the purposes of this section,—

(a) ”company” means a body corporate and includes a firm or other association of individuals; and

(b) ”director”, in relation to a firm, means a partner in the firm.”

COMPETITION COMMISSION OF INDIA (GENERAL)

REGULATIONS, 2009 (as it stood at the relevant time)

21. Procedure for Inquiry under Section 26 of the Act.-

* * *

(7) If the report of the Director General mentioned under sub-regulation (1) finds contravention of any of the provisions of the Act, the Secretary shall obtain the orders of the Commission for inviting objections or suggestions from the Central Government or the State Government or the statutory authority or the parties concerned, as the case may be.

(8) On consideration of the objections or suggestions from the Central Government or the State Government or the statutory authority or the parties concerned, or the report of further investigation of further inquiries, as the case may be, if the Commission is of the opinion that further inquiry is called for, the Secretary shall fix the meeting of the Commission for consideration thereof, after issue of notice as per Regulation 22, to the Central Government or the State Government or the statutory authority or the parties concerned, as the case may be.

22. Mode of service of notice, etc.–(1) Every notice or other document required to be served on or delivered to any person, under these regulations, may be served personally or sent by registered post, or by speed post or by courier service at the address furnished by him or her or it for service, or at the place where the person ordinarily resides or carries on business or occupation or works for gain.

* * *

48. Procedure for imposition of penalty under the Act.–

(1) Notwithstanding anything to the contrary contained in any regulations framed under the Act, no order or direction imposing a penalty under Chapter VI of the Act shall be made unless the person or the enterprise or a party to the proceeding, during an ordinary meeting of the Commission, has been given a show cause notice and reasonable opportunity to represent his case before the Commission.

(2) In case the Commission decides to issue show cause notice to any person or enterprise or a party to the proceedings, as the case may be, under sub-regulation (1), the Secretary shall issue a show cause notice giving not less then fifteen days asking for submission of the explanation in writing within the period stipulated in the notice.

(3) The Commission shall, on receipt of the explanation, and after oral hearing if granted, proceed to decide the matter of imposition of penalty on the facts and circumstances of the case.”

21. With effect from 18.05.2023, amendments to Sections 26, 27 and 48 of the Act read as under: –

Procedure for inquiry under section 19.—

(2A) The Commission may not inquire into agreement referred to in section 3 or conduct of an enterprise or group under section 4, if the same or substantially the same facts and issues raised in the information received under section 19 or reference from the Central Government or a State Government or a statutory authority has already been decided by the Commission in its previous order.

(3A) If, after consideration of the report of the Director General referred to in sub-section (3), the Commission is of the opinion that further investigation is required, it may direct the Director General to investigate further into the matter.

(9) Upon completion of the investigation or inquiry under sub-section (7) or sub-section (8), as the case may be, the Commission may pass an order closing the matter or pass an order under section 27, and send a copy of its order to the Central Government or the State Government or the statutory authority or the parties concerned, as the case may be:

Provided that before passing such order, the Commission shall issue a show-cause notice indicating the contraventions alleged to have been committed and such other details as may be specified by regulations and give a reasonable opportunity of being heard to the parties concerned.

27. Orders by Commission after inquiry into agreements or abuse of dominant position.— Where after inquiry the Commission finds that any agreement referred to in section 3 or action of an enterprise in a dominant position, is in contravention of section 3 or section 4, as the case may be, it may pass all or any of the following orders, namely:—

(a) direct any enterprise or association of enterprises or person or association of persons, as the case may be, involved in such agreement, or abuse of dominant position, to discontinue and not to re-enter such agreement or discontinue such abuse of dominant position, as the case may be;

(b) impose such penalty, as it may deem fit which shall be not more than ten per cent. of the average of the turnover or income, as the case may be, for the last three preceding financial years, upon each of such person or enterprise which is a party to such agreement or has abused its dominant position:

Provided that in case any agreement referred to in section 3 has been entered into by a cartel, the Commission may impose upon each producer, seller, distributor, trader or service provider included in that cartel, a penalty of up to three times of its profit for each year of the continuance of such agreement or ten per cent. of its turnover or income, as the case may be, for each year of the continuance of such agreement, whichever is higher.

Explanation 1.— For the purposes of this clause, the expression “turnover” or “income”, as the case may be, shall be determined in such manner as may be specified by regulations.

Explanation 2.—For the purposes of this clause, “turnover” means global turnover derived from all the products and services by a person or an enterprise.

* * * * *

(d) direct that the agreements shall stand modified to the extent and in the manner as may be specified in the order by the Commission;

(e) direct the enterprises concerned to abide by such other orders as the Commission may pass and comply with the directions, including payment of costs, if any;

* * * * *

(g) pass such other [order or issue such directions] as it may deem fit:

Provided that while passing orders under this section, if the Commission comes to a finding, that an enterprise in contravention to section 3 or section 4 of the Act is a member of a group as defined in clause (b) of the Explanation to section 5 of the Act, and other members of such a group are also responsible for, or have contributed to, such a contravention, then it may pass orders, under this section, against such members of the group.

48. Contravention by companies.— (1) Where a person committing contravention of any of the provisions of this Act or of any rule, regulation, order made or direction issued thereunder is a company, every person who, at the time the contravention was committed, was in charge of, and was responsible to the company for the conduct of the business of the company, as well as the company, shall be deemed to be in contravention of this Act and unless otherwise provided in this Act, the Commission may impose such penalty on such persons, as it may deem fit which shall not be more than ten per cent. of the average of the income for the last three preceding financial years:

Provided that in case any agreement referred to in sub- section (3) of section 3 has been entered into by a cartel, the Commission may unless otherwise provided in this Act, impose upon such persons referred to in sub-section (1), a penalty of up to ten per cent. of the income for each year of the continuance of such agreement.

(2) Nothing contained in sub-section (1) shall render any such person liable to any penalty if he proves that the contravention was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such contravention.

(3) Notwithstanding anything contained in sub-section (1), where a contravention of any of the provisions of this Act or of any rule, regulation, order made or direction issued thereunder has been committed by a company and it is proved that the contravention has taken place with the consent or connivance of, or is attributable to any neglect on the part of, any director, manager, secretary or other officers of the company, such director, manager, secretary or other officers shall also be deemed to be in contravention of the provisions of this Act and unless otherwise provided in this Act, the Commission may impose such penalty on such persons, as it may deem fit which shall not be more than ten per cent. of the average of the income for the last three preceding financial years:

Provided that in case any agreement referred to in sub- section (3) of section 3 has been entered into by a cartel, the Commission may, unless otherwise provided under this Act, impose upon such person a penalty as it may deem fit which shall not exceed ten per cent. of the income for each year of the continuance of such agreement.

Explanation.—For the purposes of this section,—

(a) “company” means a body corporate and includes a firm or other association of individuals;

(b) “director”, in relation to a firm, means a partner in the firm;

(c) “income”, in relation to a person, shall be determined in such manner as may be specified by regulations.”

(Emphasis supplied)

22. With effect from 17.09.2024, the Competition Commission of India (General) Regulations, 2024 introduced the following amendments to Regulation 22 and renumbered Regulation 48 as 49 with certain additions which reads thus:-

Procedure for inquiry under section 26 of the Act –

(8) Upon completion of further inquiry in terms of sub- sections (7) or (8) of section 26 of the Act, the Commission may pass a final order closing the matter under sub-section (9) of section 26 of the Act or pass an order under section 27, before which it shall issue a show-cause notice to the parties concerned, in terms of the proviso to sub-section (9) of section 26 of the Act, indicating the contraventions alleged to have been committed and the time period for responding to the notice.

(9) Upon receipt of reply to the show-cause notice referred to in sub-regulation (8) from the parties concerned, and after giving them a reasonable opportunity to be heard, the Commission may pass a final order closing the matter of pass an order under section 27 of the Act.

49. Procedure for imposition of penalty under the Act.

(1) Notwithstanding anything to the contrary contained in any regulations framed under the Act, no order or direction imposing a penalty under Chapter VI of the Act shall be made unless the person or the enterprise or a party to the proceeding, during an ordinary meeting of the Commission, has been given a show cause notice and reasonable opportunity to represent his case before the Commission.

(2) In case of persons proceeded against in terms of section 48 of the Act, forwarding of the investigation report and/or the supplementary investigation report or issue of show- cause notice under sub-regulation (8) of regulation 22 of these regulations, as the case may be, to such persons, shall be deemed to be the show cause notice in terms of sub- regulation (1) above.

(3) In case the Commission decides to issue show cause notice to any person or enterprise or a party to the proceedings, as the case may be, under sub- regulation (1), the Secretary shall issue a show cause notice giving not less than 15 (fifteen) days asking for submission of the explanation in writing within the period stipulated in the notice.

(4) The Commission shall, on receipt of the explanation, and after oral hearing if granted, proceed to decide the matter of imposition of penalty on the facts and circumstances of the case.”

ANALYSIS OF THE PROVISIONS

23. A careful examination of Section 26 of the Act, as it stood at the relevant time, indicates the following:- On receipt of a reference from the Central Government or a State Government or a Statutory Authority or on its own knowledge or information received under Section 19, if the Commission forms an opinion that there exists a prima facie case, the Commission shall direct the Director General to cause an investigation to be made into the matter. On the contrary, if the Commission forms an opinion, that there is no prima facie case, it shall close the matter forthwith and pass such orders as it deems fit and send a copy of its order to the Central Government or the State Government or the Statutory Authority or the parties concerned, as the case may be.

24. The Director General on receipt of a direction under sub-Section (1) from the Commission shall submit a report on his findings within such period as may be specified by the Commission.

25. On receipt of the report the Commission has to forward a copy of the report to the Central Government or the State Government or the Statutory Authority or the parties concerned.

26. Thereafter, certain crucial sub-sections occur in Section 26. In the report if the Director General recommends that there is no contravention, the Commission shall invite objections or suggestions from the Central Government or the State Government or the Statutory Authority or the parties concerned, as the case may be, on such report of the Director General.

27. If after consideration of the objections or suggestions received from the Central Government or the State Government or the Statutory Authority or the parties concerned the Commission agrees with the recommendation of the Director General that there is no contravention, the Commission shall close the matter forthwith and pass such orders as it deems fit and communicate its orders to the Central Government or the State Government or the Statutory Authority or the parties concerned, as the case may be.

28. Now, if after consideration of the objections or suggestions sent by the Central Government, State Government or the Statutory Authority or the parties concerned the Commission is of the opinion that further investigation is called for, it may direct further investigation in the matter by the Director General or cause further inquiry to be made in the matter or itself proceed with further inquiry in the matter in accordance with the provisions of the Act.

29. Similarly, if the report of the Director General referred to in sub- section 3 recommends that there is contravention of any of the provisions of the Act, and the Commission is of the opinion that further inquiry is called for, it shall inquire into such contravention in accordance with the provisions of the Act.

COMMISSION CAN DIFFER WITH THE DG:-

30. It will be seen that if the Director General finds no contravention, still the Commission can not only direct further investigation by Director General but, can also cause further inquiry to be made in the matter or itself proceed with further inquiry in the matter. This would mean that even in cases where Director General has not found any contravention, the Commission may find contravention after the inquiry. Similarly, if the Director General finds contravention and the Commission is of the opinion that further inquiry is called for it shall inquire into such contravention.

31. Under the Regulations, as it then stood, in case the Commission decides to inquire into the matter under Section 26 of the Act, a copy of the report is forwarded to the Central Government or the State Government or the Statutory Authority or the parties concerned.

32. Thereafter, a meeting is fixed of the Commission after service of notice under Regulation 22. Additionally, Regulation 48, as it then stood, prescribed that no order or direction imposing a penalty under Chapter VI of the Act (which includes Section 48) shall be made unless the person or the enterprise or a party to the proceeding, during an ordinary meeting of the Commission, has been given a show cause notice and reasonable opportunity to represent his case before the Commission.

33. We will also briefly notice this position post the amendment of Section 26 w.e.f. 18.05.2023 and of the Regulations in 2024. Sub- Section (9) has been added to Section 26 which provides that upon completion of the investigation or inquiry under sub-section (7) or sub-section (8), the Commission may pass an order closing the matter or pass an order under Section 27, and send a copy of its order to the Central Government or the State Government or the Statutory Authority or the parties concerned, as the case may be. The proviso to sub-section 9 states that before passing such order, the Commission shall issue a show cause notice indicating the contraventions alleged to have been committed and such other details as may be specified by Regulations and give a reasonable opportunity of being heard to the parties concerned.

34. The new Regulations, notified on 17.09.2024, provided in Regulation 49 with slight modifications what was provided in Regulation 48 earlier. The modification was that an express provision was incorporated in sub-Regulation 2 to the effect that in case of persons proceeded against in terms of Section 48 of the Act, forwarding of the investigation report and/or the supplementary investigation report or issuance of show-cause notice under sub- regulation 8 of Regulation 22 shall be deemed to be show cause notice in terms of sub-Regulation 1 of Regulation 48. Sub-Regulation 8 of Regulation 22 provided that upon completion of further inquiry in terms of sub-section (7) or (8) of Section 26 of the Act, the Commission may pass a final order closing the matter under sub- section 9 of Section 26 of the Act or pass an order under Section 27, before which it shall issue a show-cause notice to the parties concerned, in terms of the proviso to sub-section (9) of Section 26 of the Act, indicating the contraventions alleged to have been committed and the time period for responding to the notice.

35. Hence, it will be clear that prior to the amendment of Section 26 in 2023, once the Director General files the report, and the Commission does not feel the need for a further investigation/inquiry, all that is required is to issue a notice to the party by forwarding the report eliciting an answer to the contravention. In case the parties are not able to give a satisfactory answer and violation of the Act is found, penalty may be imposed under Section 48. It may happen that, in the event of the Director General not finding a contravention and the Commission on further investigation or inquiry finding contravention, mere forwarding of the report of the Director General or the supplementary report of DG will be of no avail. In that situation the notice should set out the new findings arrived at which are the aspects where the Commission has differed with the Director General. This principle is akin to the situation prevalent in service jurisprudence about the Disciplinary Authority being obligated to serve a notice setting out the areas where such authority differs from the inquiry officer.

36. In Yoginath D. Bagde v. State of Maharashtra and Another.1, this Court held as under:

“28. In view of the provisions contained in the statutory rule extracted above, it is open to the disciplinary authority either to agree with the findings recorded by the enquiring authority or disagree with those findings. If it does not agree with the findings of the enquiring authority, it may record its own findings. Where the enquiring authority has found the delinquent officer guilty of the charges framed against him and the disciplinary authority agrees with those findings, there would arise no difficulty. So also, if the enquiring authority has held the charges proved, but the disciplinary authority disagrees and records a finding that the charges were not established, there would arise no difficulty. Difficulties have arisen in all those cases in which the enquiring authority has recorded a positive finding that the charges were not established and the delinquent officer was recommended to be exonerated, but the disciplinary authority disagreed with those findings and recorded its own findings that the charges were established and the delinquent officer was liable to be punished. This difficulty relates to the question of giving an opportunity of hearing to the delinquent officer at that stage. Such an opportunity may either be provided specifically by the rules made under Article 309 of the Constitution or the disciplinary authority may, of its own, provide such an opportunity. Where the rules are in this regard silent and the disciplinary authority also does not give an opportunity of hearing to the delinquent officer and records findings different from those of the enquiring authority that the charges were established, “an opportunity of hearing” may have to be read into the rule by which the procedure for dealing with the enquiring authority’s report is provided principally because it would be contrary to the principles of natural justice if a delinquent officer, who has already been held to be “not guilty” by the enquiring authority, is found “guilty” without being afforded an opportunity of hearing on the basis of the same evidence and material on which a finding of “not guilty” has already been recorded.”

37. As far as the present case is concerned, the Director General’s report was concurred with by the Commission and hence a notice in the nature of the one issued on 10.06.2015 which is traceable to Regulation 21 read with Regulation 48 and 22 and Section 26 of the Act is enough compliance with the provisions of the Act, for the purpose of imposition of a penalty under Section 27.

38. In Competition Commission of India vs. Steel Authority of India Limited And Another.2, this Court observed as under:-

“71. The intimation received by the Commission from any specific person complaining of violation of Section 3(4) read with Section 19 of the Act, sets into motion, the mechanism stated under Section 26 of the Act. Section 26(1), as already noticed, requires the Commission to form an opinion whether or not there exists a prima facie case for issuance of direction to the Director General to conduct an investigation. This section does not mention about issuance of any notice to any party before or at the time of formation of an opinion by the Commission on the basis of a reference or information received by it. Language of Sections 3(4) and 19 and for that matter, any other provision of the Act does not suggest that notice to the informant or any other person is required to be issued at this stage. In contradistinction to this, when the Commission receives the report from the Director General and if it has not already taken a decision to close the case under Section 26(2), the Commission is not only expected to forward the copy of the report, issue notice, invite objections or suggestions from the informant, the Central Government, the State Government, statutory authorities or the parties concerned, but also to provide an opportunity of hearing to the parties before arriving at any final conclusion under Sections 26(7) or 26(8) of the Act, as the case may be. This obviously means that wherever the legislature has intended that notice is to be served upon the other party, it has specifically so stated and we see no compelling reason to read into the provisions of Section 26(1) the requirement of notice, when it is conspicuous by its very absence. Once the proceedings before the Commission are completed, the parties have a right to appeal under Section 53-A(1)(a) in regard to the orders termed as appealable under that provision. Section 53-B requires that the Tribunal should give, parties to the appeal, notice and an opportunity of being heard before passing orders, as it may deem fit and proper, confirming, modifying or setting aside the direction, decision or order appealed against.”

(Emphasis supplied)

NOTICE DATED 10.06.2015: –

39. It is undisputed that the DG who investigated the complaint concluded that Respondent No.1-KFEF contravened Section 3(3) of the Act causing appreciable adverse effects on competition. The report also by name found Respondent Nos.2 and 3 as the key persons/key decision makers who played active role in Respondent No.1-KFEF. It is also undisputed that the appellant, by its order of 10.06.2015, upon consideration of the DG Report forwarded the Report to Respondent No.2, Mr. Basheer Ahamed, President of Respondent No.1, and Respondent No.3 Mr. M.C. Bobby, General Secretary of Respondent No.1, with a direction to the individuals to file their replies and also furnish their audited balance sheet and profit and loss account for the F.Y. 2011-12, 2012-13, 2013-14 on or before 14.07.2015. They were also asked to appear for oral hearing on 22.07.2015. They were heard through common counsel by the Commission on the said date. The notice dated 10.06.2015 is set out hereinbelow:-

“In the present case the commission vide its order dated 8th May 2014 under section 26 (1) of the Completion Act. 2002 (Act) had Director General (DG) to cause an investigation into the matter. Accordingly, the DG, after completion of the investigation, had filed the investigation report.

The commission considered the investigation report filed by the DG in its ordinary meeting held today the commission decided to forward an electronic copy of the investigation report of the parties for filing their replies. The commission also decided to forward electronic copy of the investigation report of the DG to Shri Basheer Ahamed, president of OP and Shri M.C. Bobby, General Secretary of OP (the persons identified by the DG as office bearers of OP who at the time of contravention of the provisions of the Act were found to be the key decision makers among the office bearers of OP) for filing their replies/objections. The commission directed the parties including the said individuals to file their replies/objections latest by 14th July 2015. The informant is directed to provide a copy of its replies/objections to the Opposite parties and each of the opposite parties is directed to provide a copy of its replies/objections to the informant.

The OP is directed to furnish its audited balance sheet and profit and loss account/turnover for the financial years 2011-12, 2012-13 and 2013-14 latest by 14th July 2015. The aforesaid individuals are directed to file their income details including their Income Tax Returns for the financial years 2011-12, 2012-13 and 2013-14 latest by 14th July 2015.

The parties are directed to appear before the commission, either in person or through their duly authorized representative, for an oral hearing on 22 July 2015 at 10:30 AM.

The Secretary is directed to inform all concerned for necessary compliance.”

(Emphasis supplied)

40. This notice is in terms of Section 26 of the Act read with Regulation 21 as it then stood. Equally, the notice also fulfils the requirement of Section 48 of the Act read with Regulation 21 and Regulation 48 of the Commission (General) Regulations, 2009, as it then stood.

41. After hearing the parties and analyzing the evidence, the Commission, by its order of 08.09.2015, found Respondent Nos. 1-3 to have indulged in anti-competitive conduct in violation of Section 3 of the Act. Thereafter, it imposed penalties on Respondent Nos. 1-3 including the monetary penalty. Apart from monetary penalty, Respondent No.1 was directed not to associate Respondent Nos. 2 and 3 with its affairs including administration, management and governance in any manner for a period of two years. Correspondingly, Respondent Nos.2 and 3 were also directed not to associate with Respondent No.1 for a period of two years.

42. Under Section 48, every person who, at the time of the contravention, was in charge of, and was responsible along with the company was deemed to be guilty of the contravention and was liable to be proceeded and punished. The liability was fixed by the statute itself. The notice of 10.06.2015 was categoric in pointing out the fact that there are contraventions alleged in the DG Report and it was clear in fixing the individuals who were the key personnel in charge of the affairs of Respondent No.1. A clear opportunity was given to file reply/objections. Respondent Nos.2 and 3 can complain of no prejudice if on the basis of this notice, the Commission held them guilty for contravening the Act and proceeded to impose penalty under Section 27. We are fully convinced that the notice dated 10.06.2015 issued in the present case fulfils the requirement in law as it then stood.

43. Since we are not concerned with the amended statute w.e.f. 18.05.2023 and the regulations w.e.f. 17.09.2024, we make no comment on the same.

CONTRAST OF THE ACT WITH THE MRTP ACT, 1969 : –

44. To understand the nature of penalties that can be imposed under the Act, one has to necessarily contrast the penalty provisions of the Act with its precursor, the MRTP Act. Under the MRTP Act, the Commission had limited powers of passing only cease and desist orders. Only after the cease-and-desist orders are passed and if there was a violation, certain penalties were prescribed. The net result was, a violator could violate the law with impunity and on receipt of a cease-and-desist order, cease the activity. There was no deterrent inasmuch as there was no penalty for the violation and only a penalty for violation of an order passed by the Commission was contemplated. This was found to be very ineffective.

45. It will be noticed that under Section 27, the Commission apart from monetary penalty, can also direct imposition of cease and desist orders and other behavioural and/or structural remedies.

46. In an erudite monograph titled “Remedies and Commitments in Abuse Cases” by Dr. Anna Renata Pisarkiewicez (Consultant, OECD), presented as a Background Note to OECD Competition Policy Roundtable, the concept of behavioral remedies and structural remedies that are imposed by competition agencies to penalize anti- competitive behavior is lucidly discussed. They are reproduced hereunder: –

“3.2. Behavioural remedies

In contrast to structural remedies, which seek to restore competition by requiring changes in the structure of the dominant firm’s business, behavioural or conduct remedies alter how a dominant firm conducts its operations. Depending on whether the implementation of behavioural remedies involves third parties, such as other market participants, or not, behavioural remedies can be broadly divided into internal and external. The former does not involve third parties and relate to firm’s internal management and organisation. For example, a dominant firm might be required to introduce a compliance programme or change its corporate governance provisions. The latter, on the other hand, concern a firm’s interaction with third parties, and may require the dominant firm, for example, to modify or terminate its existing contracts or alter its pricing schemes. There are also behavioural remedies that concern firm’s internal operations, but are prone to affect third parties, or the market in general. A pre-installation of a dominant firm’s own software might be a case in point.

Behavioural or conduct remedies can be positive/declaratory or negative/prohibitor, depending on whether they require a company to do or to stop doing something, or both. Negative remedies, which typically take the form of a cease-and- desist order simply require the defendant to stop the abusive behaviour. Positive remedies tend to reflect the abusive behaviour. For example, a remedy to a refusal to supply would be a duty to supply. The countermeasure to anti-competitive self-preferencing would be an obligation not to discriminate. Of course, the distinction between positive and negative remedies can be seen as purely semantic as any prohibition can be easily translated into a positive obligation, i.e. a prohibition not to engage in abusive tying corresponds to a positive obligation to untie jointly sold produces or services. Moreover, negative and positive remedies can be applied jointly, i.e. a negative cease-and-desist order might be complemented by a set of positive remedies that prescribe a specific behaviour.

As behavioural remedies are tailor made, allowing competition agencies to shape them according to the needs of a specific case, they can come in many forms. Examples of behavioural remedies that have been imposed in past abuse of dominance decisions include obligations to:

-

-

- Modify or terminate existing contracts (these might include, for example, extension of the notice period to inform about intention to discontinue commercialisation or amendment of license conditions);

- Eliminate exclusivity provisions;

- Introduce and comply with new pricing schemes or conditions;

- Enable customers’ or consumers’ switching;

- Adopt compliance programmes or set up trainings in competition law;

- Amend corporate governance

-

While a competition authority might choose to impose just one behavioural remedy, in practice often a set of complementary remedies is imposed on dominant firms. Moreover, behavioural remedies can complement structural remedies with a view to ensuring the effective implementation of the latter.

3.1. Structural remedies

Structural remedies require firms to divest, release or carve-out certain tangible or intangible assets they own. They have several important advantages. By removing the very source of a dominant firm’s ability and incentive to engage in an anticompetitive conduct, they help to eliminate, or at least decrease the dominant firm’s market power and create conditions favourable to entry and competition. They are also relatively simple to devise and implement as due to their one-off nature they do not typically require extensive, time- and resource-consuming monitoring, so typical of behavioural remedies. Moreover, they are difficult for companies to circumvent and avoid.”

(Emphasis supplied)

47. Section 48, as it stood at the relevant time, provided that with regard to body corporates, firms and association of individuals (compendiously referred to as a Company in the statute), every person who, at the time the contravention was committed, was in charge of, and was responsible to the company for the conduct of the business of the Company, as well as the Company, was deemed to be guilty of contravention and was liable to be proceeded against and punished accordingly. The proviso to Section 48(1) stated that if the concerned individual proves that the contravention was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such contraventions, such person would not be held liable. Sub-section 2 of Section 48 provided that even with regard to any Director, Manager, Secretary or other Officer of the Company, they shall also be deemed to be guilty if the contravention has been committed by the Company and it is proved that the contravention had taken place with consent or connivance of the said individual or if the contravention is attributable to any negligence on the part of any Director, Manager, Secretary or other Officer of the Company. By the 2023 Amendment, a cap on monetary penalty of 10 per cent of the average income for the last 3 preceding financial years was fixed.

48. The Act which is intended to provide teeth to the regulator, namely, the Commission to check anti-competitive agreements and abuse of dominant position empowers the Commission, under Section 27, to pass monetary penalties as well as behavioural and structural remedies and such power is traceable to the opening clause of Section 27 read with Section 27(a) (b) (d) (e) and (g). The idea was that the contravention be effectively brought to an end, keeping in mind the principle of proportionality.

49. A behavioural remedy or a structural remedy is principally imposed on the enterprise. When a behavioural remedy impinges on corporate governance, corollary orders to give effect to the behavioural remedy may have to be made on individuals. Stricto senso the penalty is on the enterprise and the corollary direction is a consequential direction to give effect to the penalty imposed on the enterprise. Without such powers to impose corollary directions, behavioural remedies and structural remedies imposed on enterprises which incidentally impinge on individuals could never be given effect to. The behavioural remedy imposed on Respondent No. 1 can never be given effect to unless the corollary part of that direction, directing the Respondent No. 2 and 3 not to associate themselves with Respondent No.1 (KFEF), is given effect to. This also reinforces the holding that the penalty of a behavioural remedy is primarily on Respondent no. 1 with incidental consequences on Respondent Nos. 2 and 3.

PRINCIPLE OF PROPORTIONALITY IN PENALTY IMPOSITION : –

50. As the study by Dr. Anna Renata Pisarkiewicz sets out, a proportional remedy is one that addresses the identified competition concern, without going beyond what is necessary to remedy it. This implies that in abuse cases proportional remedies should restore, as much as possible, the competitive situation that existed before the abuse occurred, without seeking to improve the market structure that existed prior to the abuse. Further, length of the application of remedies should be balanced inasmuch as while it should be long enough to allow intended effects to materialize and short enough to account for the dynamic nature of the markets.

51. In Excel Crop Care Limited vs. Competition Commission of India And Another.3, this Court recognized the doctrine of proportionality in the context of Section 27 of the Act in the following terms:-

“92. Even the doctrine of “proportionality” would suggest that the court should lean in favour of “relevant turnover”. No doubt the objective contained in the Act viz. to discourage and stop anti-competitive practices has to be achieved and those who are perpetrators of such practices need to be indicted and suitably punished. It is for this reason that the Act contains penal provisions for penalising such offenders. At the same time, the penalty cannot be disproportionate and it should not lead to shocking results. That is the implication of the doctrine of proportionality which is based on equity and rationality. It is, in fact, a constitutionally protected right which can be traced to Article 14 as well as Article 21 of the Constitution. The doctrine of proportionality is aimed at bringing out “proportional result or proportionality stricto sensu”. It is a result-oriented test as it examines the result of the law in fact the proportionality achieves balancing between two competing interests : harm caused to the society by the infringer which gives justification for penalising the infringer on the one hand and the right of the infringer in not suffering the punishment which may be disproportionate to the seriousness of the Act.”

NO SECOND NOTICE CONTEMPLATED UNDER THE STATUTE: –

52. In this background, reverting to the question at hand, it will be clear that all that the Act contemplates after the receipt of a report from the DG indicating contravention is to set the procedure in motion under Section 26(8) of the Act, as it then stood, read with Section 48 of the Act, Regulation 21 and 48 of the Commission (General) Regulations, 2009. This aspect has already been dealt with. There is no mandate in the statute for the issuance of a second show cause notice setting out the proposed penalty.

REPORT OF THE ‘REVIEW COMMITTEE’: –

53. This view that no second notice is contemplated is reinforced by the Report of the Competition Law Review Committee (for short the “Review Committee”) July, 2019. That Review Committee adverted to the judgment of the Division Bench of Delhi High Court in Mahindra and Mahindra Ltd. v. Competition Commission of India and Another.4. We should immediately point out that we are only referring to this judgment since it is referred to as a part of the findings of the 2019 Report of the Review Committee. This judgment is pending in appeal before this Court and we should not be taken to have observed one way or the other on the correctness or otherwise of the said judgment. That judgment dealt with the constitutional validity of Section 27 since the argument in that case was that the provision is unconstitutional for want of a prescription for a separate penalty hearing. The Division Bench of the High Court held the provision to be constitutional. In the present matter, we are not concerned with the constitutional validity of Section 27 and the case has been placed only on the anvil of its interpretation.

54. The Review Committee dealing with the aspect of separate penalty hearing from para 3.14 to 3.19 observed as under:-

“Separate Penalty Hearing

3.14. Currently, the Competition Act does not mandate the CCI to provide a separate penalty hearing and the CCI hears the parties on merits and penalties together. In this regard, a concern that was flagged before the Committee was that parties may not get adequate opportunity to be heard on penalties, including on mitigating and aggravating factors. Accordingly, the Committee considered whether a separate hearing should be provided to the parties before the CCI passes its orders on penalties.

3.15. Notably, the Delhi High Court in Mahindra & Mahindra Ltd. v. Competition Commission of India dealt with a similar issue where the petitioner alleged that Section 27(b) of the Competition Act is unconstitutional inter-alia on the ground that no separate penalty hearing is provided under the provision.

After reviewing the procedure for conducting investigation, inquiry and passing of final orders under the Competition Act, the High Court held that the absence of a second specific hearing before imposition of a penalty under Section 27(b) does not expose the provision to the vice of arbitrariness and unconstitutionality. The Court observed that:

“197. If these considerations are kept in mind, the fact that certain types of penalties (which are pre- determined quantum for specific violations of the Act) elicit show cause notice as prelude to penalty on the one hand, and absence of any compulsion to issue a separate show cause notice preceding a penalty under Section 27(b) (although a show cause notice and full hearing is provided with opportunity to submit against the report of DG) does not in the opinion of this Court, render that provision arbitrary.

198. The court is cognizant of the fact that there are several adjudications – quasi judicial and by judicial tribunals, which envision a “rolled up” hearing which visualizes only one show cause notice – that can culminate in both an adverse finding and a consequential penalty.”